- Remuneration for the next 13 months is expected to be 53 euro cents per share, equivalent to 22% of the current share price, the highest proportion of income of any peer in Spain

- Remuneration against 2024 earnings includes cash dividends, which are more than triple those of the previous year, and a 1.002 billion euro share buyback programme to distribute capital exceeding the 13% CET1 ratio

- The bank’s profitability grew by 343 basis points in the year, reaching ROTE of 14.9% and is expected to be circa 14% in 2025 and above that in 2026

- Net interest income rose, with strong growth in mortgage lending and business financing

- Balance sheet quality improved, with the bank’s NPL ratio at its lowest level since 2009

- TSB contributed 253 million euros to Group profit, the highest annual figure since its acquisition in 2015

- Josep Oliu: “We are returning a record amount of remuneration to shareholders. No banking peer in Spain plans to pay out a similar proportion of income. We are starting the new year with confidence and ambition.”

- César González-Bueno: “Banco Sabadell has achieved a record profit in 2024, and we are on an exceptional growth trajectory. As we look ahead, we are confident that our strategy will continue to deliver long term sustainable growth and value for shareholders”.

7 February 2025

Banco Sabadell Group achieved record profit of 1,827 million euros in 2024, up by 37.1% year-on-year, having outperformed the historic high of 500 million euros in each of the last two quarters, on the back of a dynamic business performance in Spain in both retail and business banking, and a growing contribution from TSB.

On the back of these results and with the positive forecasts for the current year, the Board of Directors of Banco Sabadell has increased its estimated shareholder remuneration against earnings for 2024 and 2025 from 2.9 billion euros, as announced last July, to 3.3 billion euros.

This figure is equivalent to a dividend of 61 cents per share for the two years as a whole. This remuneration includes cash dividends of 20.44 cents per share for 2024 and an expected at least equal amount per share for 2025, as well as share buyback programmes to distribute the capital in excess of 13%. This year, it has earmarked 1,002 million euros for that purpose, pending approval by the Annual General Meeting of Shareholders.

After paying out eight cents in an interim dividend on 1 October, the bank plans to distribute to its shareholders a total of 53 cents per share over the next 13 months, equivalent to 22% of its current stock market value.

Oliu: “We have tripled our cash dividend”

The Chairman of Banco Sabadell, Josep Oliu, explained: “The Board of Directors has decided to increase its shareholder remuneration given the bank’s strong financial performance, solid and recurring capital generation, and confident outlook”.

“We tripled the cash dividend in 2024 and, in the next 13 months, shareholders will have received remuneration equivalent to 22% of the value of Sabadell shares. No banking peer in Spain plans to pay out a similar proportion of income”, he said, and expressed his confidence that Banco Sabadell is positioned to continue to deliver attractive shareholder returns in the coming years.

“We are starting the new year with confidence and ambition, firm in our conviction that Banco Sabadell’s standalone strategy will continue to generate recurring and sustainable value for shareholders, customers, our colleagues and society as a whole”, he indicated.

The bank’s CEO, César González-Bueno, highlighted: “Banco Sabadell has achieved record profit in 2024, and we are on an exceptional growth trajectory. Our strategy is delivering, with high and sustainable levels of profitability and excellent risk quality. Our strong capital generation enables us to return €3.3bn to shareholders including over €1bn in buybacks this year. As we look ahead, we are confident that our strategy will continue to deliver long term sustainable growth and value for shareholders”.

He also remarked that: “The commitment and engagement of all those who form part of the Banco Sabadell team has been key to the bank´s exceptional performance across all business units. I´d like to thank our colleagues for continuing to deliver the very best service and customer care to support our SMEs, companies, the self-employed and families”.

CFO, Sergio Palavecino, noted “the further improvement of asset quality through the year has enabled us to reduce provisions and lower our cost of risk, thereby achieving record quarterly profits of 532 million euros in the last quarter of the year”. He also expressed his confidence that “the bank’s excellent capacity to generate capital and our positive outlook gives us confidence to continue to return high levels of capital to shareholders”.

Strong growth of capital and profitability

Banco Sabadell once again boosted its financial strength in 2024, mainly driven by increased revenue, cost containment and continuous improvement of asset quality, which has enabled it to reduce allocations to provisions and improve its cost of risk beyond the anticipated level.

As a result of this level of profit, the Group generated 83 basis points of capital in the year, with the CET1 ratio standing at 13%, after announcing the share buyback programme. Its Return on Tangible Equity (RoTE) also grew by 343 basis points to reach 14.9% at year-end 2024, well above the market consensus.

The institution expects to maintain these positive trends recurrently in the current year and in subsequent years. In terms of profitability, it forecasts that RoTE will be maintained at 14% in 2025 and above that level in 2026, with a further improvement to cost of risk and a strong capacity to generate capital on a recurring basis, which will allow it to maintain an attractive shareholder remuneration policy.

The bank plans to hold a Capital Markets Day to present the new financial guidance until 2027, which will serve to explain the drivers that will allow the bank to meet its news objectives. The event will take place in the second quarter, following first quarter results.

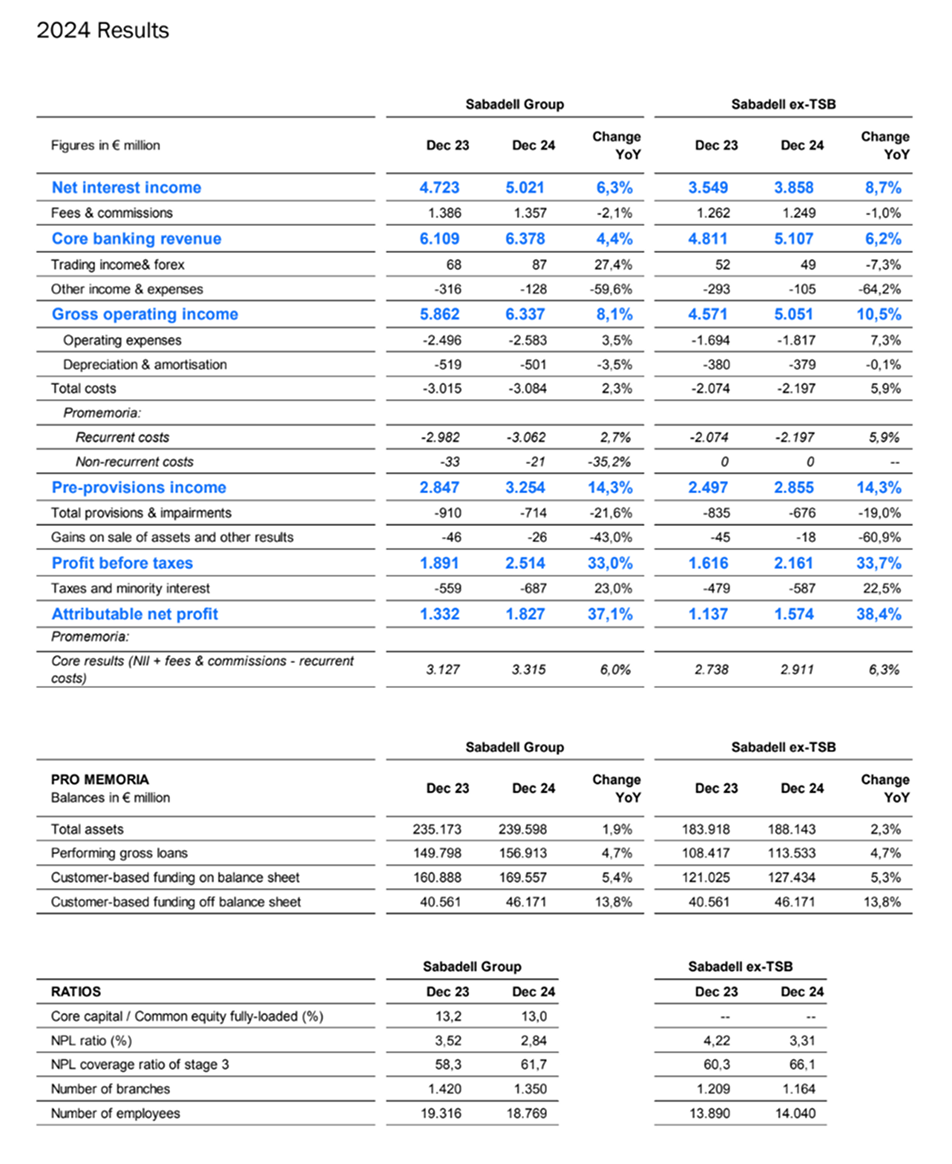

The income statement was driven by net interest income of 5,021 million euros at year-end 2024, up by 6.3% year-on-year.

Banco Sabadell expects to end this year with a margin of more than 4.9 billion euros, supported by the growth in volumes, the resilience that allows it to have more than 60% of the loan portfolio at a fixed rate and the contribution of TSB, which expects to see high single-digit growth of its net interest income this year.

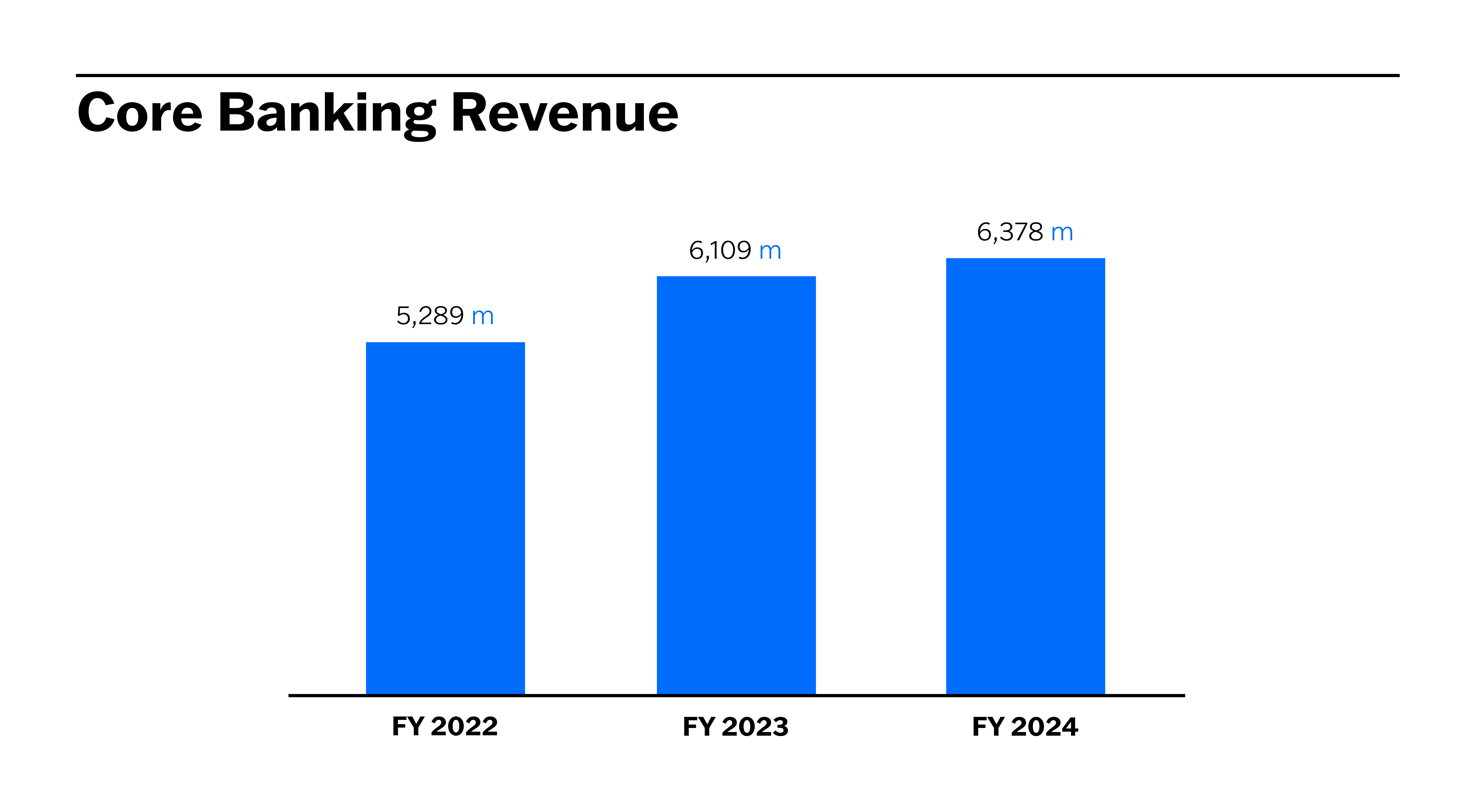

Net fees and commissions amounted to 1,357 million euros over the year, implying a 2.1% reduction year-on-year, which was better than expected. Core banking revenue (net interest income + net fees and commissions) rose to 6,378 million euros by the end of 2024, up by 4.4% year-on-year. Total costs stood at 3,084 million euros at year-end, up by 2.3% year-on-year, while recurrent costs (not taking into account extraordinary items) increased by 2.7% year-on-year, in line with expectations.

Core results (net interest income + fees – recurrent costs) posted a positive trend with growth of 6% year-on-year, after ending the year at 3,315 million euros. The cost-to-income ratio improved by 2.8 percentage points, ending the year at 48.7% in 2024, compared with 51.4% at year-end 2023.

Also noteworthy on the income statement was the reduction of total provisions by 21.61% year-on-year, declining to 714 million euros at year-end 2024, mainly as a result of continuous improvement of the risk profile.

Consequently, Banco Sabadell posted a further improvement in its credit cost of risk, which stood at 26 basis points as at the end of December. The Group’s total cost of risk also followed a similar trend of improvement and stood at 42 basis points at the end of the fourth quarter of the year.

As a result of income growth, cost containment and improved balance sheet quality, the Bank’s profit grew by 37.1% in the year to a record figure of 1,827 million euros. In the last quarter alone, the Institution earned quarterly profit of 532 million euros, 19% more than the same quarter of the previous year. Prior to the third quarter of 2024, the Institution had never reached 500 million euros of profit in a single quarter.

Strong commercial momentum

Banco Sabadell’s performing loans grew 4.7% year-on-year in 2024, with a balance of 156,913 million euros at the end of December, following strong growth in new business financing and new mortgage lending in Spain.

New business lending, that is, medium- and long-term financing plus lines of credit, amounted to 15,351 million euros between January and December, representing an increase of 31% compared to the same period of the previous year. Mortgage lending activity remained strong, growing by 53% in the year to reach 5.753 million euros.

Consumer lending also maintained a positive trend, increasing by 21% in the year, after granting 2,548 million euros in credit, with the percentage of pre-approved consumer loans reaching 90% in the fourth quarter.

Similarly, card turnover was observed to be on the increase, up by 7% year-on-year to reach 25,093 million euros at the end of December. In the same vein, the volume of transactions carried out using PoS devices increased by 8% as at December 2024, amounting to 57,041 million euros.

Customer savings and investments grow

On the liabilities side, customer funds managed by Banco Sabadell, both on- and off-balance sheet, grew by 7.1% year-on-year to reach 215,729 million euros as at December 2024.

Specifically, on-balance sheet customer funds stood at 169,557 million euros, reflecting growth of 5.4% year-on-year, due to an increase of both demand deposits and term deposits.

Off-balance sheet customer funds stood at 46,171 million euros, which indicates an increase of 13.8% year-on-year, mainly due to the good evolution of mutual funds. Customer funds held in savings and investment products in Spain increased by 3,200 million euros in the last quarter of the year, ending the year to December at 66,400 million euros.

The Group’s total assets amounted to 239,598 million euros, representing a year-on-year increase of 1.9%, despite full repayment of TLTRO III borrowing and having repaid a large portion of TFSME borrowing with the Bank of England.

Risk profile improvement

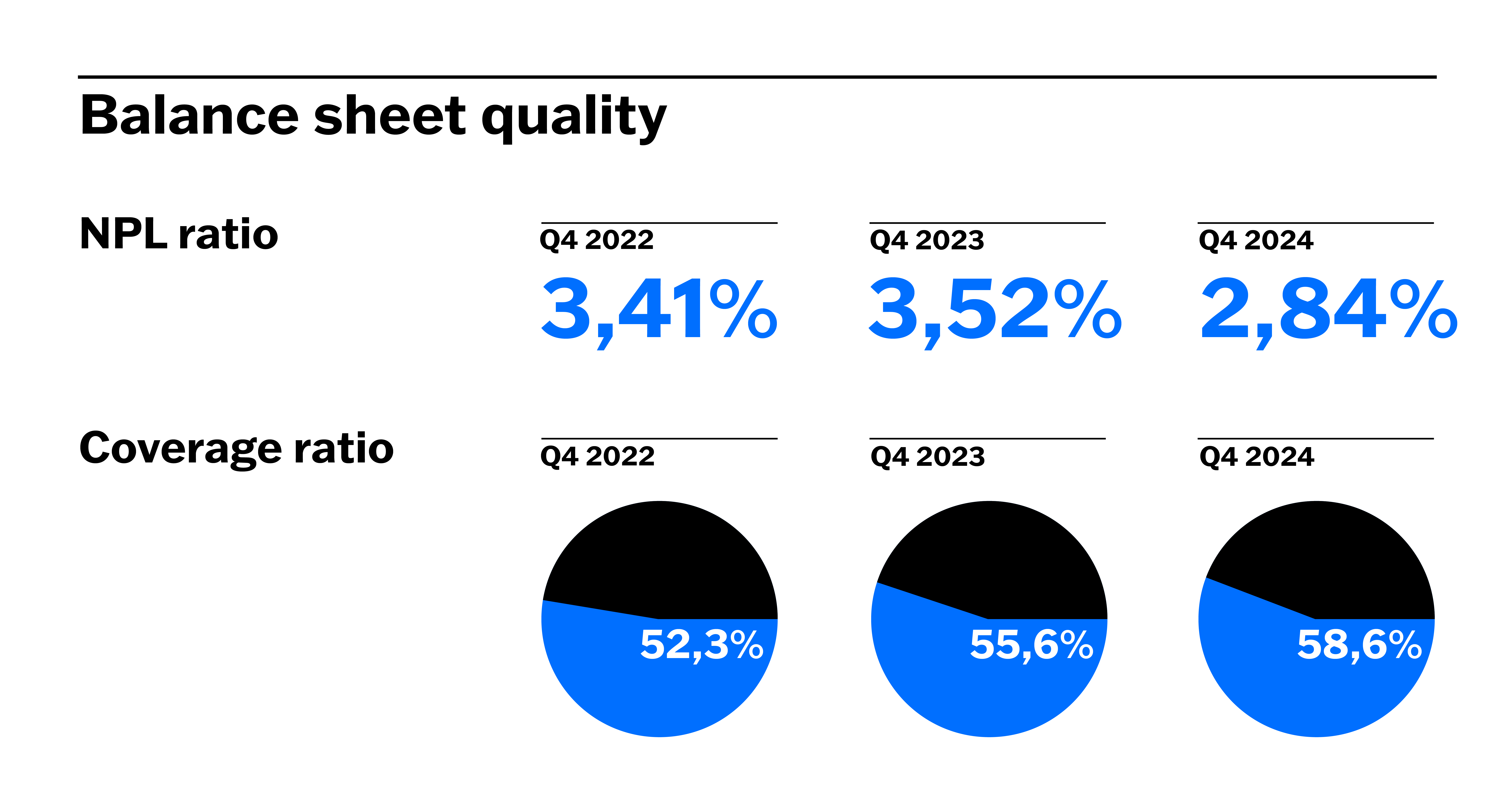

The balance of non-performing assets has declined by 1,068 million euros over the past twelve months (-16% year-on-year), ending December at 5,680 million euros, including 4,844 million euros corresponding to non-performing loans and 836 million euros to foreclosed assets.

As a result of this decline, the NPL ratio fell to 2.84% in December 2024, reaching its lowest level since 2009. This ratio is an improvement on the 3.14% posted in the quarter immediately prior, and compares even better against the ratio of 3.52% recorded at the end of 2023.

The strengthened quality of the balance sheet is also reflected in better coverage of problematic assets, which reached 58.6% at year-end, while NPL coverage (stage 3) reached 61.7%, and foreclosed asset coverage stood at 40.5%.

On the other hand, the loan-to-deposit ratio stood at 93.2% at year-end 2024, with a balanced retail funding structure, while the liquidity coverage ratio (LCR) reached 210% in December, with total liquid assets of 65,257 million euros.

TSB makes record contribution to Group profit: 253 million euros

TSB ended 2024 with standalone net profit of 208 million pounds sterling, up by 18.9% year-on-year, which boosted its positive contribution to Banco Sabadell Group profit to 253 million euros in the year overall (+29.9% year-on-year), the highest contribution since its acquisition in 2015. The subsidiary expects to see profit increase by mid-teens in the current year and continue to grow in 2026.

Core results were down by 7.3%, with lower net interest income and reduced fees and commissions, in line with expectations; however, recurrent costs fell by 3.7% following the implementation of efficiency plans.

Commercial activity at TSB remains steady, reflected by 19% year-on-year growth of new mortgage lending in the year.

Shareholder remuneration against 2024 and 2025 earnings

2024: 1.1 billion euros in cash dividends and just over 1 billion euros in share buybacks

Subject to prior approval by the Annual General Meeting, on 28 March the Institution will pay a final dividend of 12.44 euro cents (gross) per share against 2024 earnings. This amount, combined with the interim dividend of 8 euro cents per share paid out in October, represents a total cash payout in the year of 20.44 euro cents per share, equivalent to 1.1 billion euros, three times the amount paid out in the previous year. This indicates a pay-out ratio of 60%, as approved last July by the Board of Directors, in compliance with the Shareholder Remuneration Policy, which stipulates distribution of between 40%-60% of profit each year.

In addition, the Institution will allocate 1,002 million euros (equivalent to 18.69 euro cents per share) to share buyback programmes to distribute capital exceeding the 13% CET1 threshold. This year, the sum that the Bank will allocate to share buybacks will be higher than the amount usually allocated in a single year, one reason for this being that it was unable to distribute accumulated capital last year due to the launch of the hostile takeover bid by BBVA.

Banco Sabadell considers that share buybacks are beneficial to shareholders, as the reduced number of shares in circulation means more profit earned on each one, resulting in higher earnings per share, thereby increasing their intrinsic value.

The total amount distributed against 2024 earnings will be 2.1 billion euros, equivalent to 39 euro cents per share.

2025: Dividend per share to be at least the same as 2024

The Institution expects that the total cash amount per share to be paid out against 2025 earnings will be the same as, or more than, the amount paid against 2024 earnings, namely, 20.44 euro cents per share. It also intends to carry out share buyback programmes to distribute capital exceeding the 13% CET1 threshold.

The estimated distribution against earnings for 2025, when capital generation will be completely recurrent, will amount to 1.2 billion euros (or 22 euro cents per share), taking into account dividends and share buybacks.

As a departure from previous years, for dividends to be paid against earnings for 2025, the Board of Directors will put forward a proposal to the Annual General Meeting to switch from two dividend payments in the year to three. The first two will be interim dividends and will be paid out in August and December of this year, and the third will be the final dividend, which will be paid out in March 2026.