- The Bank increases its earnings by 25.9% for the nine months to September, almost equivalent to the full-year figure for 2023, delivering a record nine months and record quarterly profit

- Profitability, measured as RoTE, rises to 13.2% compared to 11.5% as at 2023 year-end

- The Bank increases its solvency by 32 basis points in the quarter and by 59 basis points year to date, reaffirming its ability to generate capital on a recurrent basis

- The good performance of lending granted to corporates, SMEs and individuals continues, with double-digit growth in the main segments

- TSB contributes to Group profit with 168 million euros during the first nine months of the year, up 4%

- Banco Sabadell reiterates its commitment to deliver recurring returns to shareholders

31 October 2024

Banco Sabadell Group earned 25.9% more between January and September this year than during the same period last year, allowing it to set a new profit record of 1,295 million euros, practically equalling the figure for the full year 2023 in just nine months.

The Institution has again demonstrated its strong capacity to generate profits and capital on a recurring basis, mainly thanks to the good performance of net interest income, higher volumes of lending granted to corporates, SMEs and individuals, as well as the positive evolution of asset quality, which has led to a reduction in provisions and an improved total cost of risk.

As a result of this level of profit, the Institution has raised its profitability, measured as RoTE, by 296 basis points in year-on-year terms to 13.2% as at the end of September. Year to date, Banco Sabadell has improved its RoTE by 174 basis points, after ending 2023 at 11.5%.

Banco Sabadell’s Chief Executive Officer, César González-Bueno, noted that “Sabadell has continued its strong momentum, delivering a record quarter and the best nine months in the bank’s history. This performance was underpinned by the strength and attractiveness of the entire Sabadell customer offer – for individuals, SMEs and larger businesses. This demonstrates continued progress across all the bank’s business units, and is testament to the hard work and commitment of the whole Sabadell team”.

González-Bueno added that “Once again this quarter, we have seen improvements in both profitability and solvency. We are well-positioned and on track for the full year. We have a proven plan to deliver shareholder value and are excited as we forge ahead”.

The Chief Financial Officer, Leopoldo Alvear, commented that “These results demonstrate the Group’s proven ability to continue generating capital organically. Banco Sabadell has added 59 basis points to its CET1 ratio in just nine months, considering the payout ratio of 60%, which represents a dividend yield of 9%”.

Alvear also remarked that “We are seeing an increasingly robust asset quality, which reduces the need to allocate provisions and improves cost of risk, both quarter-on-quarter and year-on-year. The strength of Sabadell’s financial position, combined with its earnings growth profile, provides the bank with a strong platform for the future”.

Growth of the banking business

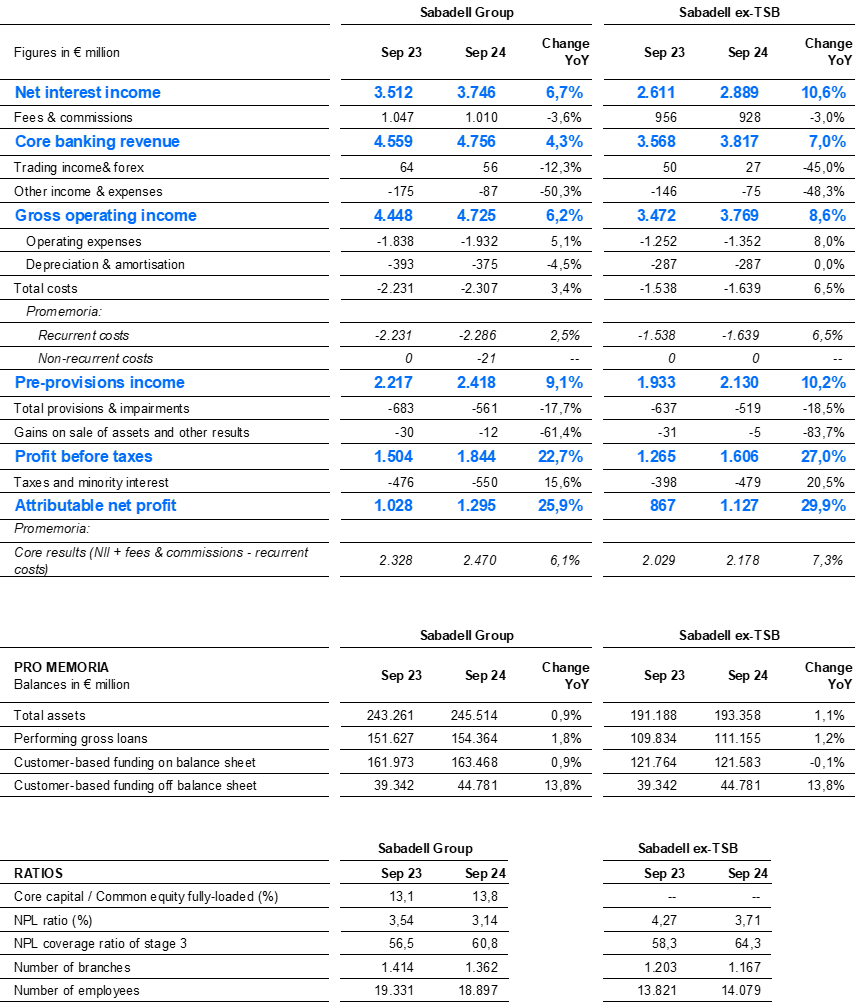

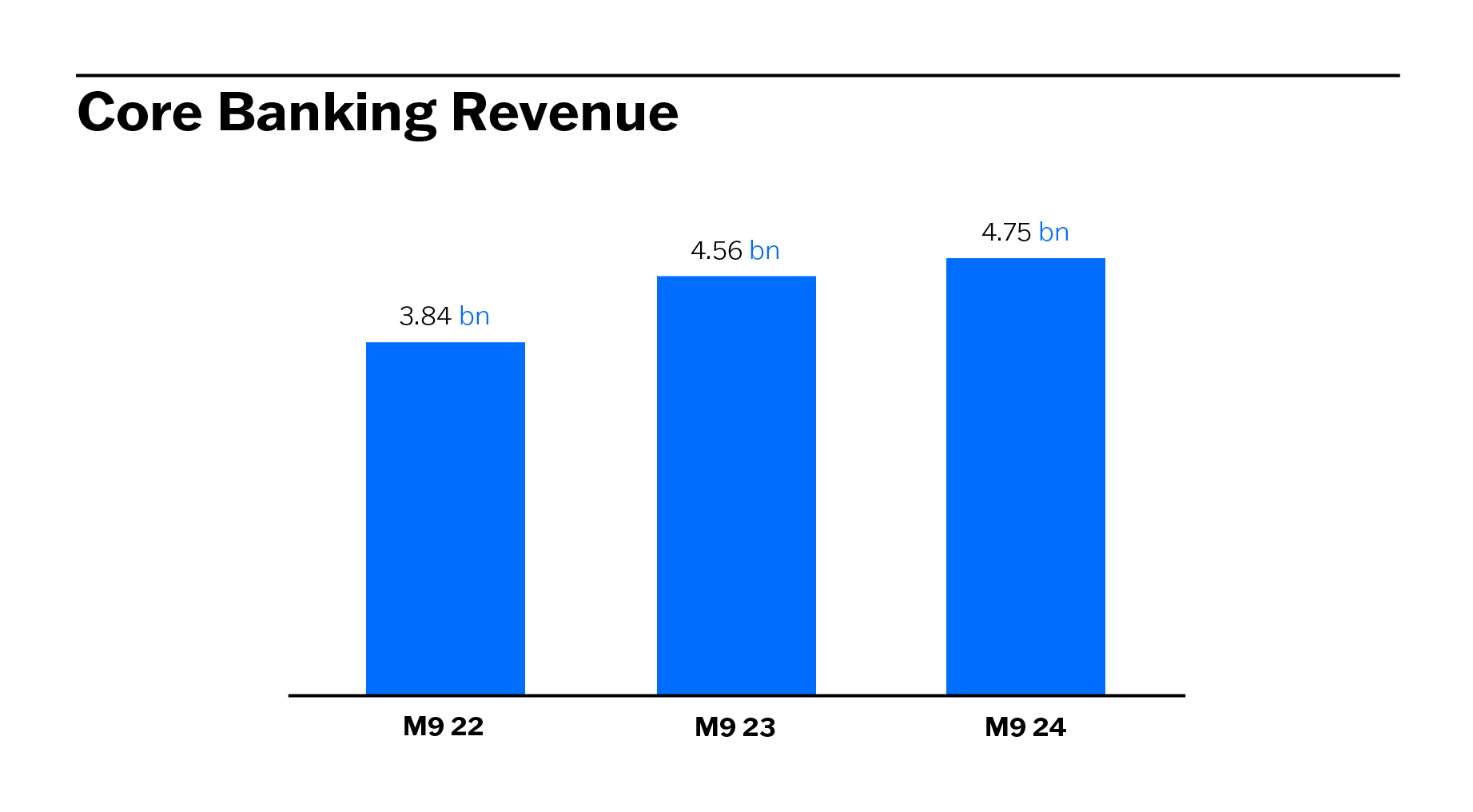

Between January and September, net interest income in particular stood out, amounting to 3,746 million euros after growing by 6.7% year-on-year, mainly driven by a higher credit yield and increased earnings on the fixed-income portfolio, while net fees and commissions stood at 1,010 million euros, down by 3.6% year-on-year and remaining within the expected range.

As a result, core banking revenue (net interest income + net fees and commissions) rose to 4,756 million euros between January and September 2024, 4.3% higher year-on-year.

Total costs came to 2,307 million euros in the first nine months of the year, representing a year-on-year increase of 3.4% after booking restructuring charges at TSB. Recurrent costs, which do not consider one-off items, were up 2.5% year-on-year, also in line with forecasts.

As such, core results (net interest income + fees – recurrent costs) posted year-on-year growth of 6.1%, standing at 2,470 million euros as at the end of September, while the cost-to-income ratio improved by 2.3 percentage points compared to the same period of the previous year, reaching 48.6% in the third quarter of 2024.

The evolution of the income statement was also driven by a reduction of total provisions, which dropped by 17.7% year-on-year to 561 million euros in September. This decline was due mainly to the improved credit risk profile across all segments of Banco Sabadell Group and to the booking of fewer provisions for real estate assets.

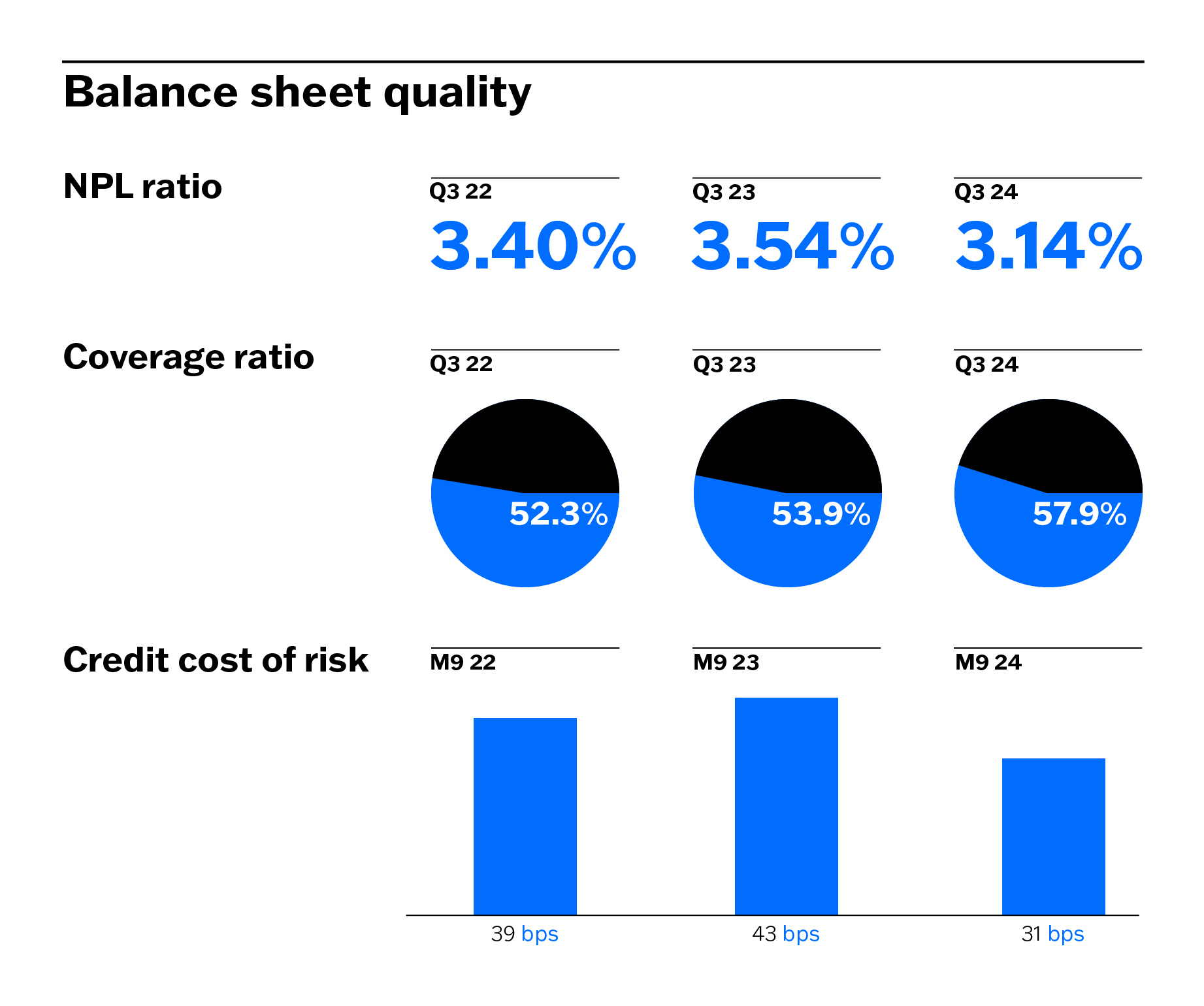

Banco Sabadell consequently posted a further improvement in its credit cost of risk, which already stood at 31 basis points as at the end of September. The Group’s total cost of risk also followed a similar trend of improvement, standing at 44 basis points at the end of the third quarter of the year.

Strong levels of activity in companies and individuals

Banco Sabadell’s performing loans posted year-on-year growth of 1.8% up to September, with a balance of 154,364 million euros, where the increase in lending granted to corporates, SMEs and individuals was particularly noteworthy.

New business lending in Spain, that is, medium- and long-term financing plus lines of credit, amounted to 11,413 million euros between January and September, representing an increase of 26% compared to the same period of the previous year.

Similarly, mortgage activity continued to show resilience from one quarter to the next, growing by 34% during the first nine months of the year to reach 3,126 million euros. In the third quarter alone, mortgages in the amount of 1,618 million euros were granted, equivalent to an increase of 82% compared to the same period in the previous year, and of 8% compared to the immediately preceding quarter, despite the seasonal effect associated with the month of August. 91% of the mortgages approved during this period were at a fixed rate of interest, meaning that 65% of the current stock is now fixed-rate, which reduces Banco Sabadell’s sensitivity to interest rate movements.

Consumer lending continued to follow a positive trend, recording growth of 17% between January and September compared to the same period in the previous year, having granted a total of 1,856 million euros. The percentage of pre-approved consumer loans was already 91% in the third quarter.

Credit card turnover also followed an upward trend, increasing by 7% year-on-year to reach 18,470 million euros as at the end of September, with more than 557 million transactions in nine months. In the same vein, the volume of transactions carried out through POS devices increased by 9% to 44,782 million euros. Banco Sabadell dataphones recorded 1,358 million transactions between January and September of this year, 13% more than in the same period of the previous year.

Higher customer savings and investment

On the liabilities side, customer funds managed by Banco Sabadell, both on- and off-balance sheet, grew by 3.4% year-on-year and came to a total of 208,249 million euros as at the end of September.

More specifically, on-balance sheet customer funds amounted to 163,468 million euros in September, representing year-on-year growth of 0.9%, while off-balance sheet customer funds came to 44,781 million euros during the same period, up by 13.8% year-on-year.

Customer funds held in savings and investment products in Spain increased by 2.6 billion euros during the quarter, to 63.2 billion euros.

The Group’s total assets amounted to 245,514 million euros, representing a year-on-year improvement of 0.9%, despite the repayment, in full, of TLTRO borrowing.

Improved credit quality

The balance sheet continues to improve, in terms of both liquidity and credit quality. The loan-to-deposit ratio, which shows the proportion of loans relative to deposits, stood at 95.2% in the third quarter of the year, with a balanced retail funding structure, while the liquidity coverage ratio (LCR) reached 209% as at the end of September, with total liquid assets of 62,080 million euros.

The balance of non-performing assets has declined by 775 million euros over the past twelve months, ending September at 6,155 million euros, including 5,283 million euros of non-performing loans and 872 million euros of foreclosed assets.

The NPL ratio stood at 3.14% in September, below the 3.21% of the previous quarter and in contrast with the 3.54% recorded at the end of the third quarter of the previous year. The improved balance sheet quality is also reflected by an increase in the NPA coverage ratio, which stood at 57.9% (+4 percentage points year-on-year). The NPL (stage 3) coverage ratio rose to 60.8% (+4.3 percentage points year-on-year) and the foreclosed asset coverage ratio reached 40.3% (+1.4 percentage points year-on-year).

Sound solvency position

It is worth mentioning that the Institution continues to demonstrate its ability to generate capital organically. As at the end of September 2024, the fully-loaded CET1 ratio stood at 13.8%, indicating an increase of 32 basis points during the quarter and of 59 basis points compared to the end of 2023. This ratio, which is well above the applicable prudential minimum requirements and which already includes the 60% payout, puts Banco Sabadell in an extremely strong position. The total capital ratio stood at 18.84% as at the end of September 2024, while the MDA buffer was 485 basis points.

Commitment to deliver recurring remuneration to shareholders

Banco Sabadell has reiterated its commitment to deliver recurring remuneration to shareholders, thanks to a solid 59 basis points of organically generated capital up to September. This figure already factors in the distribution of 60% of profits (payout ratio) and loan book growth of 3%.

It is worth remembering that Banco Sabadell plans to deliver 2.9 billion euros to shareholders, to be paid out of its earnings for 2024 and 2025, in just 18 months, which is equivalent to around 30% of Banco Sabadell’s stock market value. In addition, the entity has updated its profitability forecasts, which it plans to maintain above 13% in 2024.

On 1 October, the Institution paid a cash dividend of 8 euro cents per share (429 million euros), representing a mere 15% of the total amount envisaged for the period, during which a further payment of at least 45 euro cents per share will be made.

TSB contributes 168 million euros to the Group

TSB ended the third quarter of 2024 with standalone net profit of 59 million pounds, 44.7% more in quarter-on-quarter terms, and of 138 million pounds between January and September, equivalent to a 9.5% decline. Its positive contribution to Banco Sabadell Group’s accounts rose to 73 million euros in the third quarter (+48.7% quarter-on-quarter) and to 168 million euros (+4.3% year-on-year) during the first nine months of 2024.

The subsidiary reduced its recurring margin by 13.4% year-on-year, to 243 million pounds between January and September, although this figure increased by 14.9% compared to the immediately previous quarter, reflecting a positive and improving trend. Net interest income fell by 7% year-on-year to 730 million pounds, and net fees and commissions fell by 11.6% to 70 million pounds.

These quarterly results show a series of extraordinary items, which include restructuring charges and the fine imposed by the FCA following its investigation, during which we gave our full cooperation and rapidly implemented the requisite contingency measures. These expected one-offs have been offset by insurance recoveries.

TSB’s commercial activity remains robust, as evidenced by the 24% year-on-year growth of new mortgage lending recorded during the first nine months of the year, which allowed the mortgage balance shown on the balance sheet to remain flat (-0.2%) compared to the previous year.