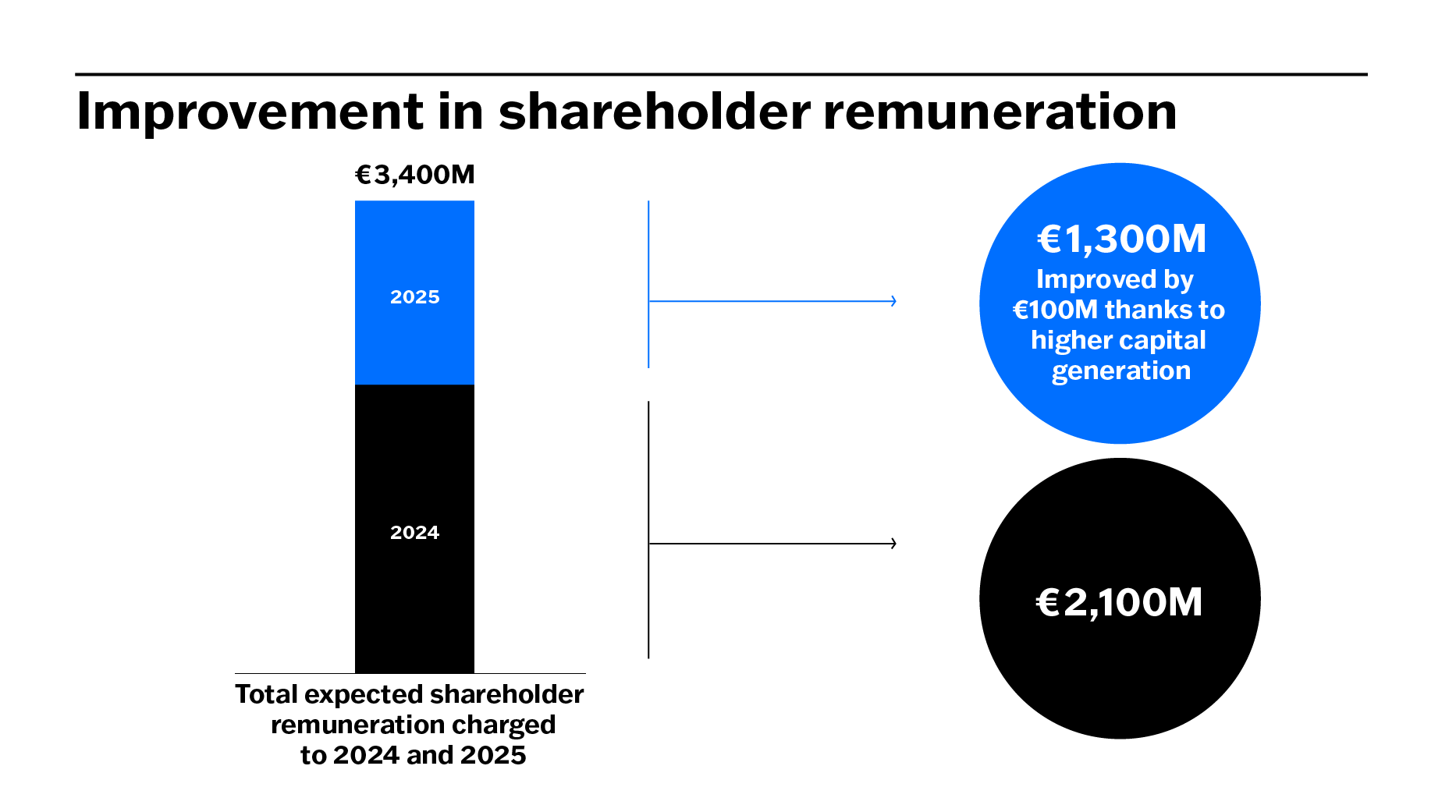

- The Bank improves its forecast for shareholder remuneration against 2025 earnings by 100 million euros, bringing it to 1.3 billion euros

- Banco Sabadell RoTE increased by 276 basis points, to reach 15.0% (14.1% recurrent RoTE)

- The positive commercial momentum in the quarter has brought performing loans up by 5% year-on-year, mainly due to a good performance in Spain in both corporate finance and mortgages

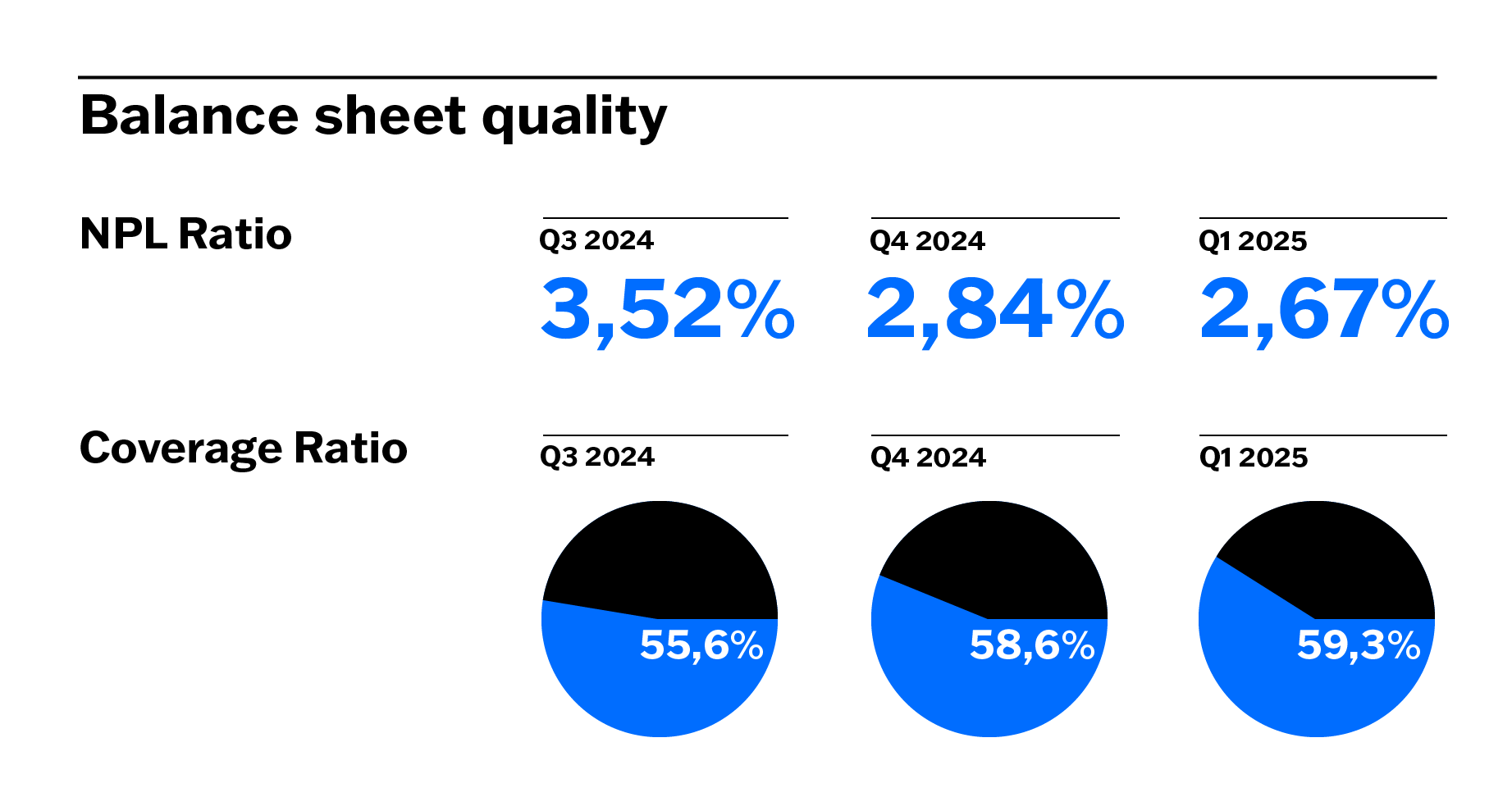

- 29.2% decrease in total provisions after lowering the NPL ratio and increasing NPA coverage, enabling total cost of risk to improve to 35bps

- The standalone net profit of subsidiary TSB increases to 74 million pounds, up 96.1% year-on-year, underpinned by the structural hedge and continued cost control. TSB’s total contribution to the Group in the quarter increased to 94 million euros

- The Bank has now executed 21% of its share buyback programmes, for an expected total amount of 1,002 million euros

8 May 2025

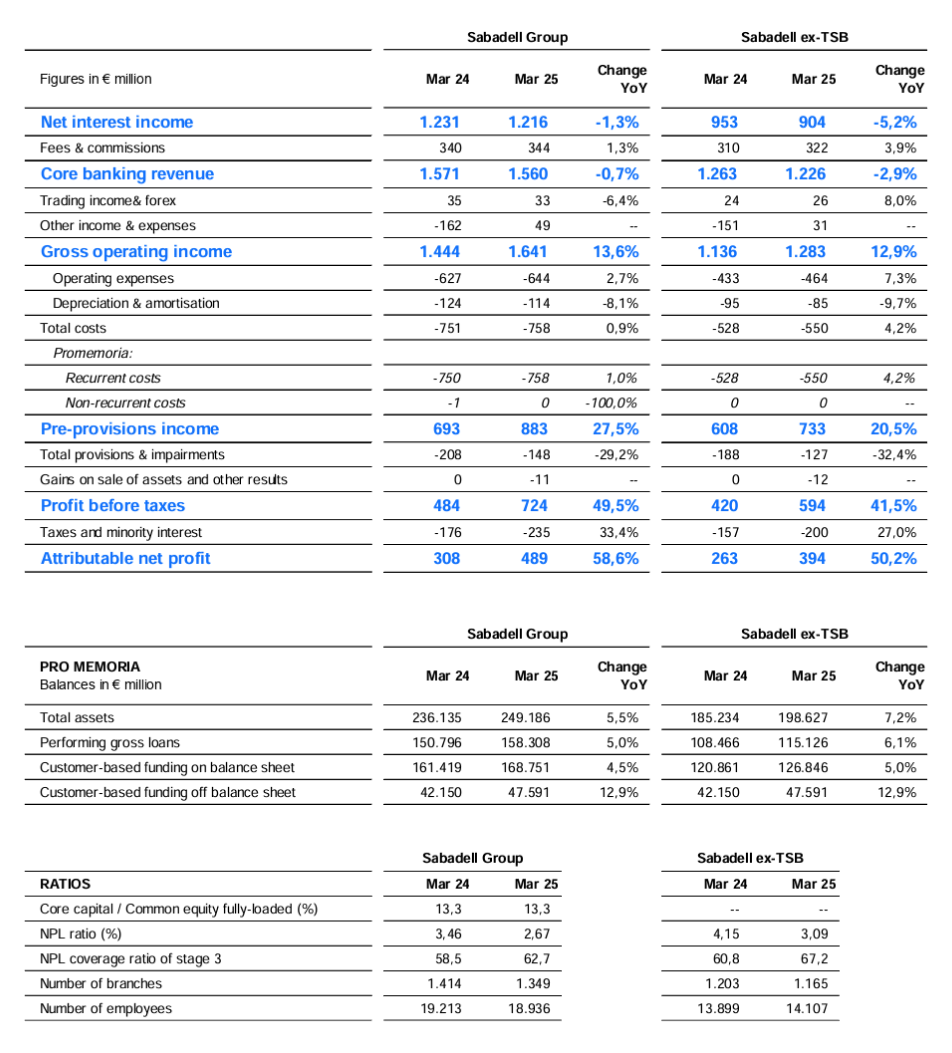

Banco Sabadell Group increased net profit to 489 million euros in the first quarter of 2025, up 58.6% year-on-year. Return on Tangible Equity (RoTE) increased by 276 basis points to 15% (14.1% recurrent RoTE).

Banco Sabadell has further strengthened its financial position in the quarter and raised its capital ratio to 13.31%, after generating 29 basis points of capital. This performance is ahead of expectations and is an improvement of 103 basis points year-on-year.

The Bank’s output has been boosted by larger volumes due to strong commercial activity, improved asset quality and, consequently, lower provisions, as well as a strong contribution from TSB to the Group’s net profit, underpinned by TSB’s structural hedge.

The results obtained in the first three months of the year are in line with 2025 guidance, and reaffirms the Bank’s commitment to delivering its plans, and confidence in its stand-alone strategy.

Chief Executive Officer, César González-Bueno, stated: “We continued the strong momentum of 2024 into the first quarter, increasing net profit by 58.6%, raising our capital ratio and increasing RoTE to 15%”.

“Despite an uncertain macroeconomic environment, our business continued to perform well across all products and segments. This performance is testament to our strategy, and underpins our confidence in delivering sustainable profitability and returning €1.3 billion to shareholders”, he said.

“Our capital generation in the quarter was ahead of expectations, and positions us to further increase our estimated shareholder remuneration for 2024 and 2025 to 3.4 billion euros, including dividends and buybacks. He concluded saying that “the commitment and hard work of our colleagues across the Bank contributed to another strong quarter and reinforces the strength of the Bank as we look ahead”, he indicated.

Chief Financial Officer, Sergio Palavecino, remarked that the Bank has delivered “another strong quarter, with very positive capital evolution, above 13%, and considerable financial resilience, reflecting our strong balance sheet. We have increased loan volumes and customer funds, while our cost of risk has improved to levels surpassing market expectations”.

Revenue remains stable

Core banking revenue (net interest income plus net fees and commissions) reached 1,560 million euros in the first quarter of 2025, not far off (-0.7%) the figure for the same period of the previous year, while net interest income reached 1,216 million euros (-1.3%) and net fees and commissions stood at 344 million euros, reflecting growth of 1.3%.

Total costs stood at 758 million euros in the first three months of the year, 0.9% higher year-on-year, in line with expectations. Core results (net interest income + fees – recurrent costs) stood at 801 million euros (-2.3%). As a result of all this, the Group’s cost-to-income ratio improved by 1.4 percentage points year-on-year, to reach 46.2%.

Also noteworthy on the income statement as at the end of March 2025 was the 29.2% decrease in total provisions, which dropped to 148 million euros, mainly as a result of an improved risk profile. With provisions at this level, Banco Sabadell has been able to improve both credit cost of risk, which was reduced by 22 basis points year-on-year bringing it to 18 basis points as at the end of the first quarter, and total cost of risk, which was reduced by 16 basis points year-on-year, reaching the better-than-expected figure of 35 basis points.

It should also be noted that bank tax of 31 million euros was booked in the quarter, which corresponds to one-quarter of the estimated total for the full year. In the first quarter of 2024, the Institution recorded this tax in full, in the amount of 192 million euros, under Other operating income and expenses, while in the first quarter of 2025 it has been booked under Corporation tax.

As a result of the above, profit increased by 58.6% to reach 489 million euros, which represents a return of 15% (14.1% recurrent return, when the bank tax payment is annualised).

Loan volumes increase

In terms of commercial activity, Banco Sabadell’s performing loans have evolved positively year-on-year, driven by good performance in Spain, with growth across all segments and a notable increase in business lending and the mortgage book, and also by businesses abroad. Specifically, performing loans had a balance of 158,308 million euros as at the end of March, representing 5.0% growth year-on-year.

In Spain, new business lending, specifically, medium- and long-term financing excluding working capital loans, amounted to 4,510 million euros in the first quarter of 2025, representing growth of 1% compared with the same period of the previous year.

In turn, mortgages have grown by 81% year-on-year in the year to March, standing at 1,645 million euros. Demand for home purchase loans is also reflected in the more dynamic performance of consumer loans, which grew by 26% year-on-year, reaching 698 million euros.

This upward trend can also be seen in card turnover, which rose by 6% to 6,060 million euros as at the end of March, and in POS turnover, which rose by 5% during the first quarter of the year, reaching 13,043 million euros.

Customer funds under management increase

In relation to liabilities, on-balance sheet customer funds ended the first quarter of 2025 with a balance of 168,751 million euros, representing a year-on-year increase of 4.5%. Demand deposit balances stood at 138,173 million euros, having grown by 2.9% year-on-year. Term deposits, on the other hand, stood at 30,431 million euros, up by 14.4% in year-on-year terms.

Off-balance sheet customer funds amounted to 47,591 million euros as at the end of March, representing a year-on-year increase of 12.9%. This increase is mainly explained by the good evolution of new mutual fund subscriptions.

Customer funds both on and off the balance sheet came to a total of 216,342 million euros in March, representing year-on-year growth of 6.3%. Similarly, total assets came to 249,186 million euros in the first quarter of the year, up by 5.5%.

Solvency and shareholder remuneration both rise

With these results, Banco Sabadell Group continues to improve its financial strength and capacity for shareholder remuneration, having generated 29 basis points of capital up to March compared to the immediately preceding quarter, placing the fully-loaded CET1 ratio at 13.31%, and 103 basis points year-on-year, all underpinned by its organic growth and a smaller-than-expected impact from the Basel reforms. The Institution plans to distribute all of the excess capital above the established CET1 level of 13%.

The phase-in Total Capital ratio stood at 17.95%, thus remaining above requirements, with an MDA buffer of 441bps, offering a comfortable regulatory buffer.

It is also worth remarking the solid liquidity position, with a Loan-to-Deposit ratio as at the end of March 2025 of 94.3%, with a balanced retail funding structure, as the Liquidity Coverage Ratio (LCR) reached 197% at the end of the quarter, with total liquid assets amounting to 63,148 million euros.

Given that the growth of capital in the first quarter has been faster than previously announced, this year the Institution will be able to dedicate 100 million euros more than estimated to remunerate its shareholders. In total, the anticipated distribution of 2025 earnings will come to 1.3 billion euros between cash dividends and share buybacks, which, when added to the 2.1 billion euros against 2024 earnings, bring the total over the two years to 3.4 billion euros. This year, the cash payment per share will be the same or higher than last year’s.

To date, Banco Sabadell has executed 21% of its planned share buyback programmes, for a total amount of 1,002 million euros for this year. Of the first phase, for which a maximum amount of 247 million euros was set, to date 86.08% has been completed. This programme was resumed at the end of March, after being suspended given the takeover bid process, and its goal is to reduce the share capital of Banco Sabadell by redeeming repurchased treasury shares, thereby contributing to improved shareholder remuneration.

Once this programme has been completed, a new one will be launched, for an amount of 755 million euros. The total will therefore be 1,002 million euros, equivalent to an investment of 18.69 euro cents per share to acquire own shares in order to distribute any excess capital above the 13% fully-loaded CET1 ratio.

The balance sheet quality continues to improve

The balance of non-performing assets was reduced by 286 million euros in three months (-5.0%), falling by around 19% year-on-year. As a result, Banco Sabadell ended March with a non-performing asset balance of 5,394 million euros, of which 4,583 million euros correspond to non-performing loans and 811 million euros to foreclosed assets.

As a result of this decline, the NPL ratio fell to 2.67% in March 2025, coming in below 3% for the second consecutive quarter. This ratio is an improvement on the 2.84% posted in the quarter immediately prior, and also compares favourably to the 3.46% figure recorded in March 2024.

As a result of the strengthened quality of the balance sheet, the coverage ratio of non-performing assets also improved considerably, climbing to 59.3%, while the coverage ratio for non-performing (stage 3) loans considering total provisions reached 62.7% and foreclosed asset coverage stood at 40.3%.

TSB bolsters its contribution to the Group with 94 million euros

TSB has reported standalone net profit of 74 million pounds in the quarter ending March 2025, due to the sound evolution of commercial activity, continued cost control as a result of strategic initiatives to simplify the business, some one-off items and the positive effect of its structural hedge. This represents a year-on-year increase of 96.1%. The British subsidiary ended the quarter with a contribution to Banco Sabadell Group of 94 million euros.

The British subsidiary’s net interest income stood at 261 million pounds for the quarter ending March 2025, having grown 9.4% year-on-year, while fees and commissions decreased by 28% year-on-year, reaching 18 million pounds. Total costs in the quarter ending March 2025 were 179 million pounds, 7.3% lower year-on-year.

In terms of commercial activity, mortgage applications, considered to be a leading indicator of mortgage origination levels, grew by 15%. In this respect, new mortgages granted increased by 12% year-on-year, to reach 1,508 million pounds. The loan book saw marginal growth, in line with the anticipated targets, while the cost of deposits improved in the quarter.