The takeover bid today

The bid launched by BBVA consists in swapping Banco Sabadell shares for newly-issued BBVA shares, in addition to a small cash component.

This operation was launched after BBVA presented a unilateral merger proposition to the Board of Directors of Banco Sabadell in April 2024, which the Board rejected as it considered it was not attractive for shareholders, customers, staff and other stakeholders.

1 share

of Banco Sabadell

0,187 shares

of BBVA + €0.13 in cash

With the initial swap of 9 May 2024, Banco Sabadell shareholders would have received 16.17% of the new BBVA, but after the latest adjustment of the swap by a dividend payment of 8 April 2025, and various share buyback schemes that have been announced, it is estimated that they would only get 14.11%.

Example of what a Banco Sabadell shareholder would obtain today if they accepted BBVA’s bid:

€10,000 in shares

of Banco Sabadell

€8,701 shares

of BBVA and cash

With the proposed swap, this shareholder would lose €1,299 of the current value of their investment.

- Reference premium at market closing on 18/07/2025.

- If the bid price (value of the BBVA share + €0.70) is less than the reference price (value of the BS share x 5.3456), the premium is negative. If it were the other way round, it would be positive.

What do you need to know to be able to decide whether to take part in the takeover or remain a Banco Sabadell shareholder?

UNTIL NOW

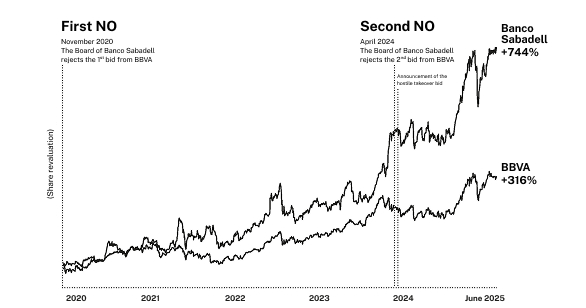

November 2020: First refusal to merge with BBVA1

A shareholder who, on 13 November 2020, had €10,000 in Banco Sabadell shares now has an investment worth €94,332 (share value + dividends collected).

However, if they had been a BBVA shareholder, their investment of €10,000 would have become €48,075 (share value + dividends received).

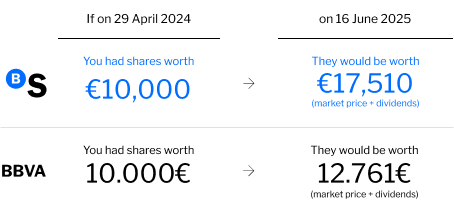

April 2024: Second refusal to merge with BBVA2

A shareholder who, on 29 April 2024, had €10,000 in Banco Sabadell shares now has an investment worth €17,510 (share value + dividends collected).

However, if they had been a BBVA shareholder, their investment of €10,000 would have become €12,761 (share value + dividends received).

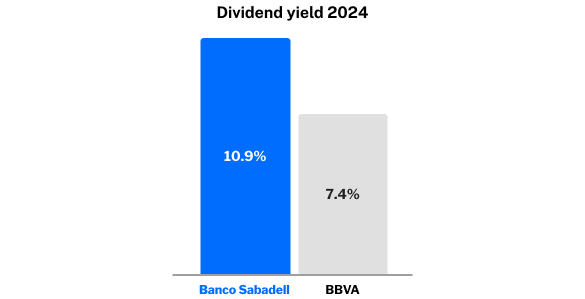

Dividend yield 2024:

- Banco Sabadell: 10.9%: the highest of all IBEX 35 companies

- BBVA: 7,4%

Sabadell is the stock that has risen the most on the Spanish stock market (IBEX 35) since the end of 2020.1

Moreover, Sabadell is the bank that has risen the most on the Spanish stock market (STOXX EUROPE 600) since the end of 2020.1

We have gone above and beyond expectations of results year after year.

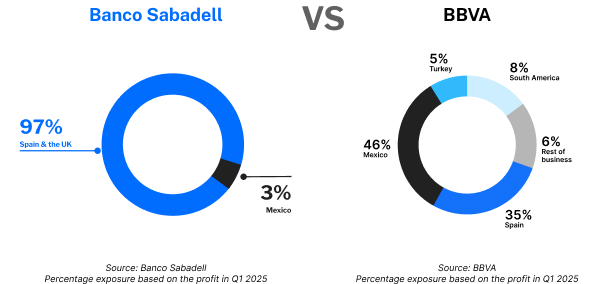

97% of our profit comes from stable and predictable markets (Spain and the UK), which allows greater predictability of our future profits.

More than 60% of BBVA‘s profits come from emerging economies: Mexico, Turkey and South America.

Saying ‘No’ to BBVA has worked out well twice for Banco Sabadell: The Board of Directors of Banco Sabadell has rejected merger bids from BBVA twice in recent years. After saying NO to BBVA on two occasions, Banco Sabadell has achieved the best financial situation in its history.

- Since November 2020, when the Board refused to continue negotiating its merger with BBVA, Banco Sabadell’s share price has risen by 9.811, while BBVA’s has risen by 4.3.

- Since BBVA’s interest in renegotiating a merger became known on 29 April, which our Board opposed, Banco Sabadell’s share price has risen by +70%, in line with Spanish domestic banks, while BBVA has only risen by 30%.

1. Source: Bloomberg. Data as at 23 May 2025. Results in base 100, adjusted for capital increases and dividends.

No. The Council of Ministers has authorised BBVA to go ahead with the hostile takeover bid, but has set additional conditions to those approved by the CNMC.

According to its decision, if the operation goes ahead, BBVA and Banco Sabadell would have to act with total management autonomy for the next three years (extendable for two more years), in addition to keeping the legal and asset-owning personalities of each entity separate. Therefore, at least during that period, a merger between the two entities could not be executed.

BBVA will have to specify in the prospectus of the takeover bid its synergies and capital cost forecasts that the operation would entail. The synergy figures announced so far did not include the measures announced by the Council of Ministers.

Past performance is not a reliable indicator of future performance. We remind you that investment in stocks and shares entails the risk of loss of the capital invested.

The evolution of stock prices and returns is subject to fluctuations due to factors intrinsic to the issuer, its environment, and sector of activity, as well as risks arising from various variables that generally affect the market in which they are traded. This may result in scenarios of both gains and losses, including the possibility of no dividend distribution.

Annual revaluation of Sabadell shares prior to 16/06/2025; 2020: -66%; 2021: 67%; 2022: 49%; 2023: 26%; 2024: 69%; 2025 to June: 51%. Annual revaluation of BBVA shares prior to 16/06/2025; 2020: -19%; 2021: 30%; 2022: 7%; 2023: 46%; 2024: 15%; 2025 to June; 40%. Source: Bloomberg Ltd.

Learn more about the ‘hostile’ takeover bid

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-1.png)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-1-1.png)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-2.png)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/banco-sabadell-no-se-pierda-nada-card-1.webp)

![$cards_featured_list_img_mobile['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/banco-sabadell-no-se-pierda-nada-card-mobile-1.webp)