- Chief Executive Officer César González-Bueno assured: “Following conclusion of the takeover bid, the solid third quarter’s results allow us to reaffirm the year-end targets set out in the Strategic Plan and confirm the shareholder remuneration estimates of 6.45 billion euros between 2025 and 2027”

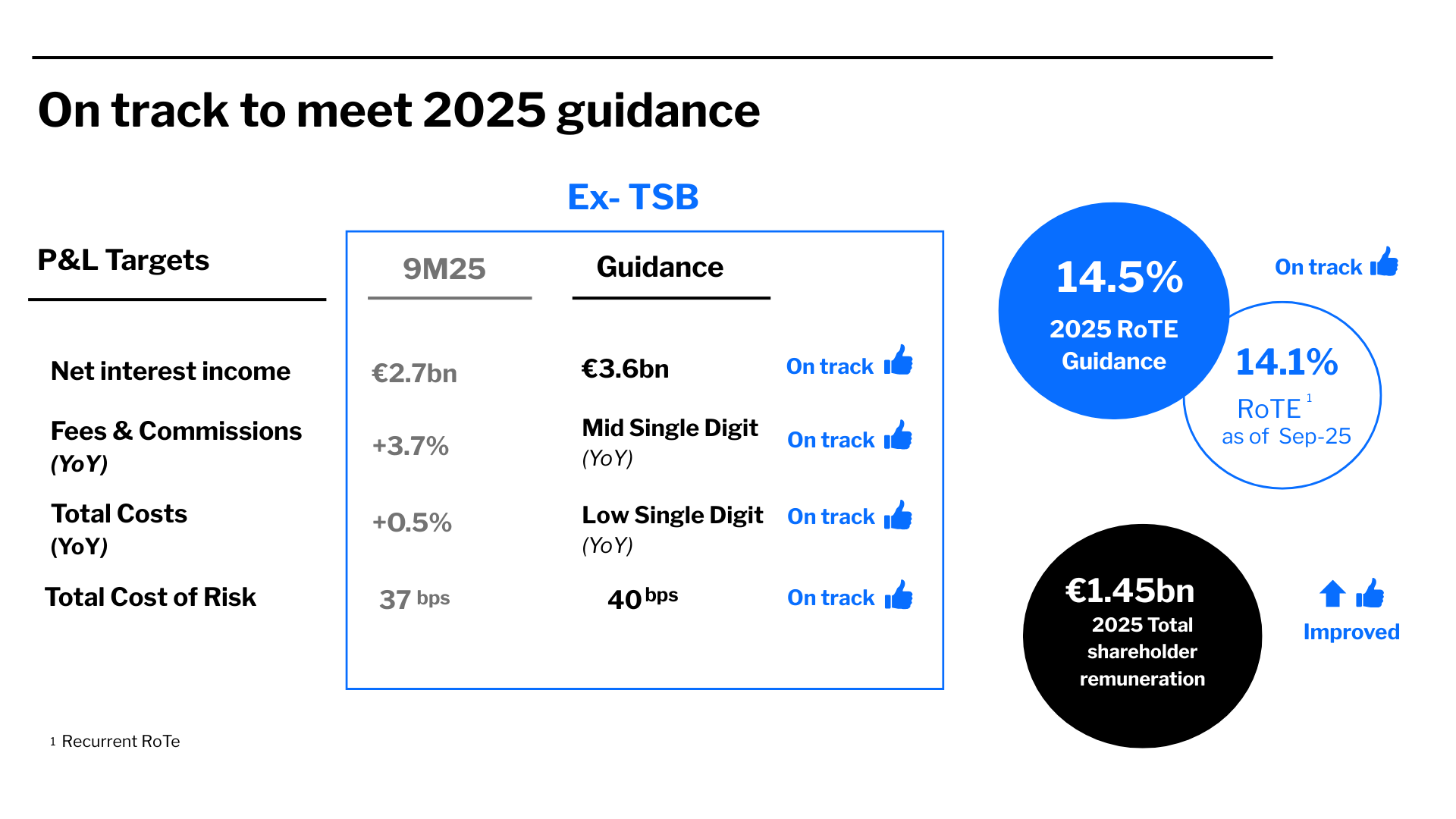

- The Bank records profitability, measured as RoTE, of 15.0% (14.1% recurring)

- The CET1 capital ratio raises to 13.74% after generating 176 basis points during the year

- Sabadell continues to accelerate commercial activity. Ex-TSB credit balance increased by 8.1% compared to the previous year, and customer funds grew by 7.8%

- Provisions fell by almost 30% year-on-year due to the improvement in the bank´s risk profile

- Chief Financial Officer Sergio Palavecino highlighted “the positive contribution of all business segments and the positive evolution in both balance sheet quality and capital generation” and affirmed that “we feel very comfortable with our goal of achieving a RoTE of 16% in 2027”

13 November 2025

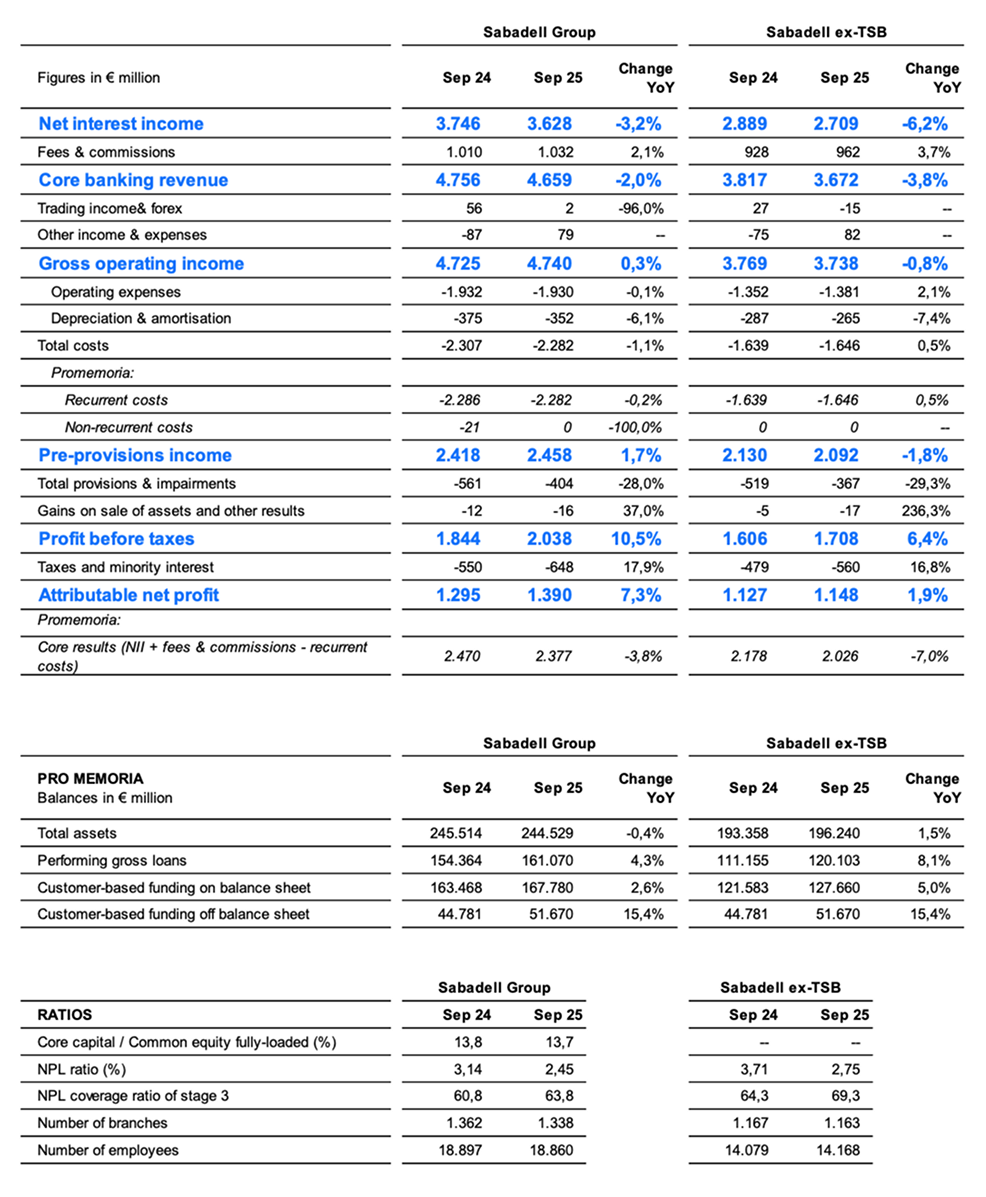

Banco Sabadell Group earned net profit of 1,390 million euros during the first nine months of 2025, representing a year-on-year increase of 7.3%, in a new profit record for the Institution between January and September.

This increase is the result of strong commercial activity, larger credit volumes (up 8.1% year-on-year ex-TSB), the good performance of customer funds (which ex-TSB recorded growth of 15.4% off-balance-sheet and of 5% on-balance-sheet), as well as a reduction of provisions (-29.3% ex-TSB) due to the Institution’s improved credit profile.

The Group’s RoTE increased to 15% reported (14.1% recurrent), compared to 13.2% one year earlier, as the CET1 capital ratio grew by 18 basis points in the quarter and 72 basis points from January to September, reaching 13.74%. Before deducting dividends, capital generated since the beginning of the year has risen to 176 basis points.

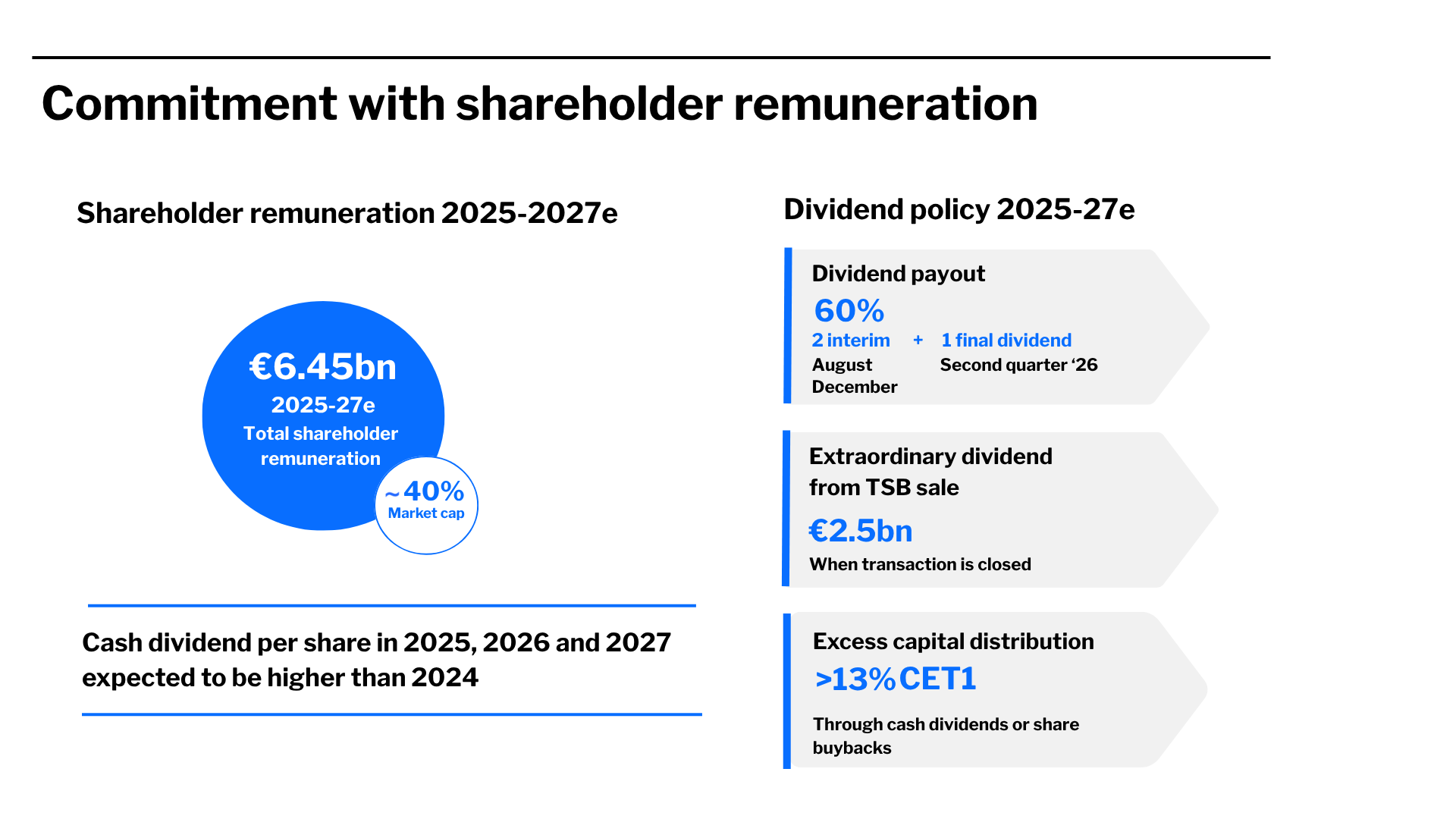

Banco Sabadell’s Chief Executive Officer César González-Bueno asserted that “following conclusion of the takeover bid, the third quarter’s solid results reaffirm that the Bank is well on track to meet the year-end targets set out in the 2025-2027 Strategic Plan and confirm its shareholder remuneration estimates of 6.45 billion euros”.

Sabadell’s CEO went on to say that “the dividend per share over the next three years will be higher than the 20.44 cents paid in 2024, while profitability will reach 16% by the end of the plan, which focuses on growth and shareholder remuneration, with Spain as the core market”.

González-Bueno highlighted the “extraordinary commitment of everyone working at the institution,” both in terms of tackling the transformation carried out in recent years and addressing the challenges that lie ahead.

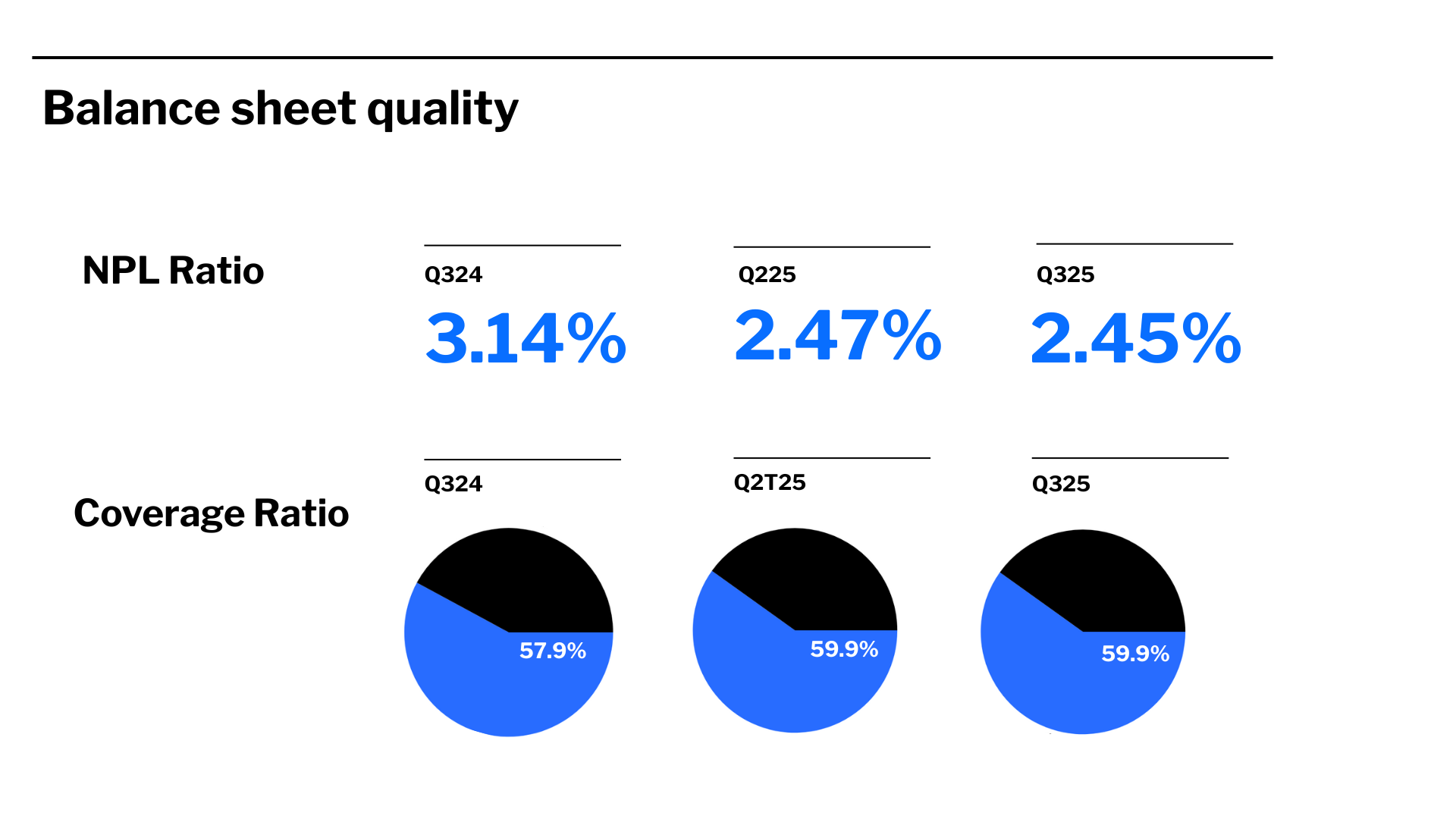

Chief Financial Officer Sergio Palavecino, for his part, remarked “the positive contribution of all business segments and the positive development both of the balance sheet quality, with the NPL ratio having been reduced further to 2.45% and stronger than expected improvement in the total cost of risk improving to reach 37 basis points ex-TSB. The Bank’s solvency has risen to 13.74%, with a significant levels of capital generation”.

Palavecino emphasized that “current profitability levels, with a recurring RoTE of 14.1% at the end of September, allow us to feel very comfortable with our target of reaching 16% by the end of 2027”.

Revenue remains stable

Between January and September 2025, Banco Sabadell earned core banking revenue (net interest income plus net fees and commissions) of 4,659 million euros (-2%). Its net interest income reached 3,628 million euros, representing a year-on-year reduction of 3.2% and a quarterly reduction of 0.5%, mainly due to lower interest rates.

However, net fees and commissions rose to 1,032 million euros as at the end of September 2025, representing year-on-year growth of 2.1% in the Group and of 3.7% excluding TSB, as a result of higher asset management and insurance fees.

Total costs came to 2,282 million euros in the first nine months of the year, falling by 1.1% year-on-year. Core results (net interest income plus fees less recurrent costs) stood at 2,377 million euros (-3.8%). As a result of all the above, the Group’s cost-to-income ratio reached 48.1% in September.

These levels place credit cost of risk at 19 basis points at the Group level and at 21 basis points ex-TSB. Similarly, total cost of risk also improved in year-on-year terms, reaching 31 basis points in the Group and 37 basis points ex-TSB.

Strong commercial momentum

In terms of commercial activity, Banco Sabadell’s performing loans showed a positive year-on-year evolution thanks to the good performance in Spain, which saw growth across all segments, notably in loans to SMEs and corporates and in consumer loans. Specifically, performing loans ex-TSB ended September with a balance of 120,103 million euros, up 8.1%.

In Spain, new mortgage loans increased by 26% year-on-year to September, reaching 5,062 million euros, with performing loans growing by 5.6% year-on-year. Demand for home purchase loans is also reflected in the more dynamic performance of consumer loans, which grew by 19% year-on-year to reach 2,216 million euros between January and September, recording the same growth proportionally speaking (+19%) as the overall consumer loan portfolio.

New loans granted to SMEs and corporates in Spain, in other words, medium- and long-term finance plus lines of credit, reached 13,902 million euros, representing a 1% drop year-on-year. However, the overall portfolio for this segment posted year-on-year growth of 6.2%.

A positive trend was also seen in card turnover, which rose by 6% to reach 19,575 million euros as at the end of September, and in turnover from PoS terminals or payment devices, which rose by 2% during the first nine months of the year to 43,683 million euros.

In terms of liabilities, total customer funds amounted to 219,450 million euros as at the end of September 2025, increasing by 5.4% year-on-year and by 0.9% during the quarter, driven by the growth of funds managed in demand deposits and mutual funds.

On-balance sheet customer funds amounted to a total of 167,780 million euros, recording year-on-year growth of 2.6%. Balances held in demand deposits amounted to 140,665 million euros, representing year-on-year growth of 5.1%, while those in term deposits came to a total of 26,762 million euros, 9.7% less in year-on-year terms, as funds flowed through to off-balance sheet products.

Total off-balance sheet customer funds came to 51,670 million euros as at the end of September, reflecting an increase of 15.4% in year-on-year terms, where it is particularly worth noting the good evolution of mutual funds, which saw more net subscriptions, as well as the increase in insurance products sold.

Non-performing exposures decrease

In terms of balance sheet quality, the Group’s NPL ratio improved to 2.45%, while its stage 3 coverage ratio with total provisions increased to 63.8%. Excluding TSB, the NPL ratio dropped to 2.75%, while the stage 3 coverage ratio with total provisions rose to 69.3%.

Non-performing assets showed a reduction of 69 million euros during the quarter, with the balance of loans classified as stage 3 falling by 26 million euros while distressed real estate assets did so by 44 million euros.

As such, the balance of Non-Performing Assets (NPAs) stood at 4,996 million euros as at the end of September 2025, of which 4,267 million euros correspond to stage 3 loans and 729 million euros correspond to distressed real estate assets.

The generation of recurrent capital continues

The fully-loaded CET1 ratio grew by 18 basis points in the quarter and 72 basis points so far this year, bringing us to a ratio of 13.74% at the end of September. Before deducting dividends, the capital generated so far this year would be 176 basis points.

The phase-in Total Capital ratio stood at 19.51%, thus remaining above requirements with an MDA buffer of 486 basis points.

Banco Sabadell’s good liquidity position was reaffirmed with a Liquidity Coverage Ratio (LCR) of 168% as at the end of September 2025 and total liquid assets of 58,817 million euros.

The Loan-to-Deposit (LtD) ratio, on the other hand, stood at 96.2% as at the same date, with a balanced retail funding structure.

Commitment to deliver high shareholder remuneration

All of the above, together with a good execution of strategy, means that the Institution has generated capital organically and steadily with a view to offering attractive remuneration to its shareholders. The estimate for 2025-2027 is 6.45 billion euros, representing close to 40% of Banco Sabadell’s current market value. The Institution maintains its expectation that the cash dividend in 2025, 2026 and 2027 will be higher than the one paid in 2024 (20.44 euro cents per share).

It is worth recalling that Banco Sabadell already approved the distribution of a second interim cash dividend from this year’s earnings, for a gross amount of 7 euro cents per share, to be paid out on 29 December. In addition to that distribution, one must add the extraordinary dividend of 2.5 billion euros, which will be distributed once the sale of TSB is completed, as well as the final dividend and the distribution of excess capital against the year’s final earnings. The share buyback programmes will continue to be used as a capital distribution tool.

It is worth recalling that Banco Sabadell already approved the distribution of a second interim cash dividend from this year’s earnings, for a gross amount of 7 euro cents per share, to be paid out on 29 December. In addition to that distribution, one must add the extraordinary dividend of 2.5 billion euros, which will be distributed once the sale of TSB is completed, as well as the final dividend and the distribution of excess capital against the year’s final earnings. The share buyback programmes will continue to be used as a capital distribution tool.

TSB will keep on contributing to the Group’s results until its sale is completed

TSB has reported standalone net profit of 198 million pounds year-to-date, representing a year-on-year increase of 43.9%, due to its cost control efforts and the positive effect of the structural hedge. The UK subsidiary ended the first nine months of the year with a contribution to Banco Sabadell Group of 242 million euros.

Its net interest income was 7% higher year-on-year at 781 million pounds, while fee and commission income decreased by 15.9% year-on-year, reaching 59 million pounds. Its total costs ended the quarter 5.3% lower at 550 million pounds.