Additional information for shareholders

Record results and leader in stock market revaluation since 2020

Throughout 2024, Banco Sabadell had excellent performance, achieving a historic profit of 1,827 million euros, 37.1% more than the previous year, which had also been record-setting. At the same time, the bank’s solvency (capital ratio) increased by 0.83 percentage points and rose to 14%. This is the highest ratio of the five largest banks in Spain and it is very important news for you, because the Board of Directors committed to shareholders months ago to return to them the excess of 13%.

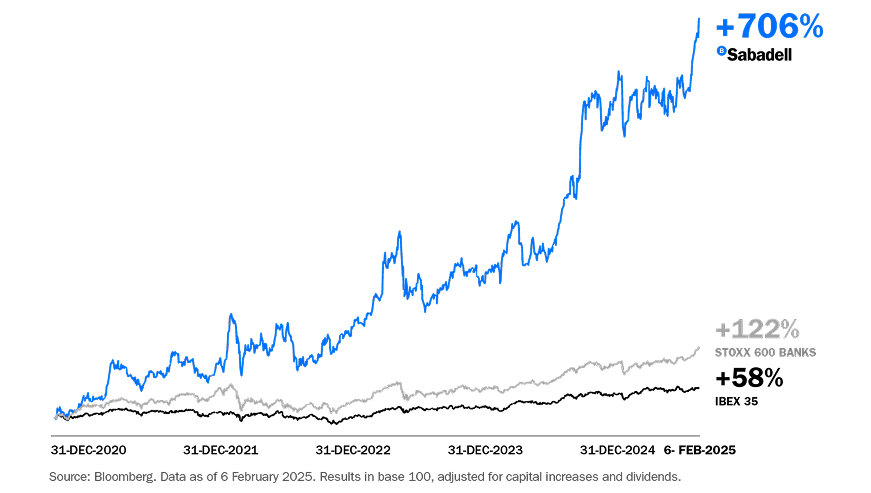

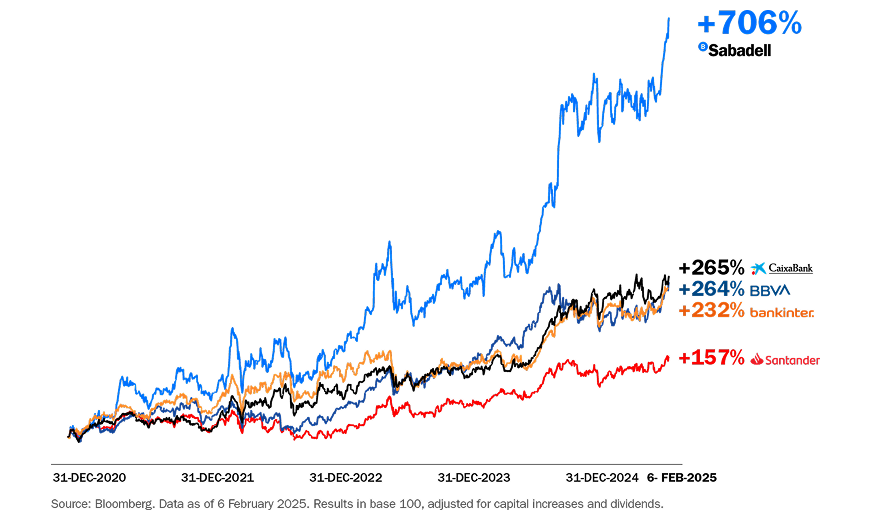

In step with the positive performance in earnings and capital, the share price rose by 79% in 2024, a figure that far exceeds the 14.8% rise of the IBEX35 in that financial year. 2025 has also started very well, with a rise of 28% until yesterday’s close.

Comparison of Sabadell, IBEX35 and STOXX EUROPE 600 BANKS shares

Share comparison of Sabadell vs peers

How will you receive the remuneration if you keep your shares?

In following, you can see the breakdown of the planned remuneration, and if you still have unanswered questions, please contact the Shareholder Service Centre at +34 937 288 882 and at accionista@bancsabadell.com.

With cash dividends

If you hold onto your shares, on 28 March, subject to approval by the Shareholders’ Meeting, you will receive a gross cash dividend of 12.44 euro cents per share. This complementary dividend charged to the 2024 results, together with the eight euro cents paid in October as an interim dividend, amounts to a total of 20.44 euro cents per share, more than three times the amount paid by the bank in cash the previous year.

And if you remain a shareholder in the following months and do not accept BBVA’s takeover bid, you will again receive two interim cash dividends in August and December 2025, in addition to the complementary dividend in March 2026. All of them are charged to the earnings achieved during this financial year and subject to the Board approving the new Shareholder Remuneration Policy. If the performance prospects for this year are met, the sum of the three cash dividends for each share in circulation will be at least the same as that received from the results of 2024. This is also very important to you because it shows that Banco Sabadell’s remuneration is sustainable over time, which is very useful when assessing the entity’s plan to remain independent.

And with distribution of excess capital through share buybacks

In addition to cash payments, the Board’s proposal to the Shareholders’ Meeting is to allocate 1,002 million euros (corresponding to approximately 19 euro cents per share) of the bank’s current excess capital to share buyback programmes. Once the current financial year is closed, we will do the same with all the capital generated this year above 13%. The bank is going to allocate a higher amount to buybacks this year than usual in a single year because, among other things, last year it was unable to distribute the capital it had gained, due to the launch of the hostile takeover bid by BBVA. Share buybacks achieve two objectives: 1) Increase the future dividend per share, and 2) increase share value.

Why do we do buybacks, how do they work and how do they affect you?

When it comes to distributing such large volumes among shareholders, as is our case, it is convenient to distribute part in dividends and part in buybacks because both approaches have their appeal. They are a very profitable combination for the shareholder, who, on the one hand, receives cash and, on the other, gets a revaluation of their shares. It is a formula that has been widely used for years by the main entities in Spain.

These operations consist of the bank buying shares on the market, accumulating them in treasury stock and finally redeeming them, that is, reducing the total number of shares of the bank in circulation. This means that forward profits are distributed among fewer shareholders, so that each of them gets a larger share of the pie, or in other words, more dividends. In addition, the shares increase their intrinsic value.

Take for example a company that has 1,000,000 shares in circulation and an annual profit of €10,000,000. Each share generates a profit per share of €10. If it decides to buy back 200,000 of its shares and reduce them to 800,000, the profit per share increases from €10 to €12.5, which undoubtedly causes:

- The dividend per share to increase

- The remaining shares will be attractive and will likely rise on the stock market as they represent a greater stake in the share capital