The way in which we shop has radically changed over the last few years, especially after the pandemic outbreak. According to the Spanish National Commission on Markets and Competition, in the last decade, eCommerce went from representing 0.7% to 7.4% of all sales in Spain. The same applies to physical purchases. They are displaying a change in trend whereby cards are overshadowing physical cash. In fact, according to data by the Nielsen consultancy, while before the pandemic 61% of transactions were completed in cash, now that is only the case for 45%.

As a consequence, as users, we need to be prepared and aware of the security options banking institutions offer us as protection for our cards. For this reason, at Banco Sabadell we have organised the webinar ‘Security for your card purchases’ led by Neus Martí, Director of Operational Control and Resilience at Banco Sabadell. Entity experts in the subject have also participated in the meeting: Ana Pina, specialist in the area of Transactional Fraud, and Raúl Vázquez, specialist in the area of Technological and Data Risk Control.

How to use your cards when making physical and online purchases

To start off the meeting, Ana Pina chose to explain something which a priori might seem evident: what differentiates a physical purchase from an online purchase. A physical purchase is one that is made through a POS (Point of Sale Terminal) and can be made either using the card, establishing contact, without it (commonly known as contactless), or using a device the card has been linked to, whether it is a mobile phone or a smartwatch. When the purchase is made using the card, with contact, it always requires the PIN code to be entered. However, when it is done contactless or using an external device, it will only require the code if the payment is for 50 EUR or more. In addition, in the event of an unusual transaction, the bank will always ask the user to verify the purchase.

As for Internet purchases, or online purchases, you do not need to have the physical card in front of you, only the data. Pina has stated that ‘the European Union space protects us with the Payment Regulations for the protection of virtual transactions from January 2021’, which means that countries within the European Union must always require double authentication when a purchase is made.

Conversely, in areas outside this territory, said double authentication will not be required. In any case, and as Raúl Vázquez points out, ‘this does not mean that it is not secure, as double authentication is an additional element for the protection of our purchases.’ Even so, it is advisable to take into account other factors, such as the way in which we have reached this website, checking whether the padlock appears at the top left and that the website begins with ‘https’. In addition, you should always look for references on the website to check that it is secure.

How to prevent card fraud

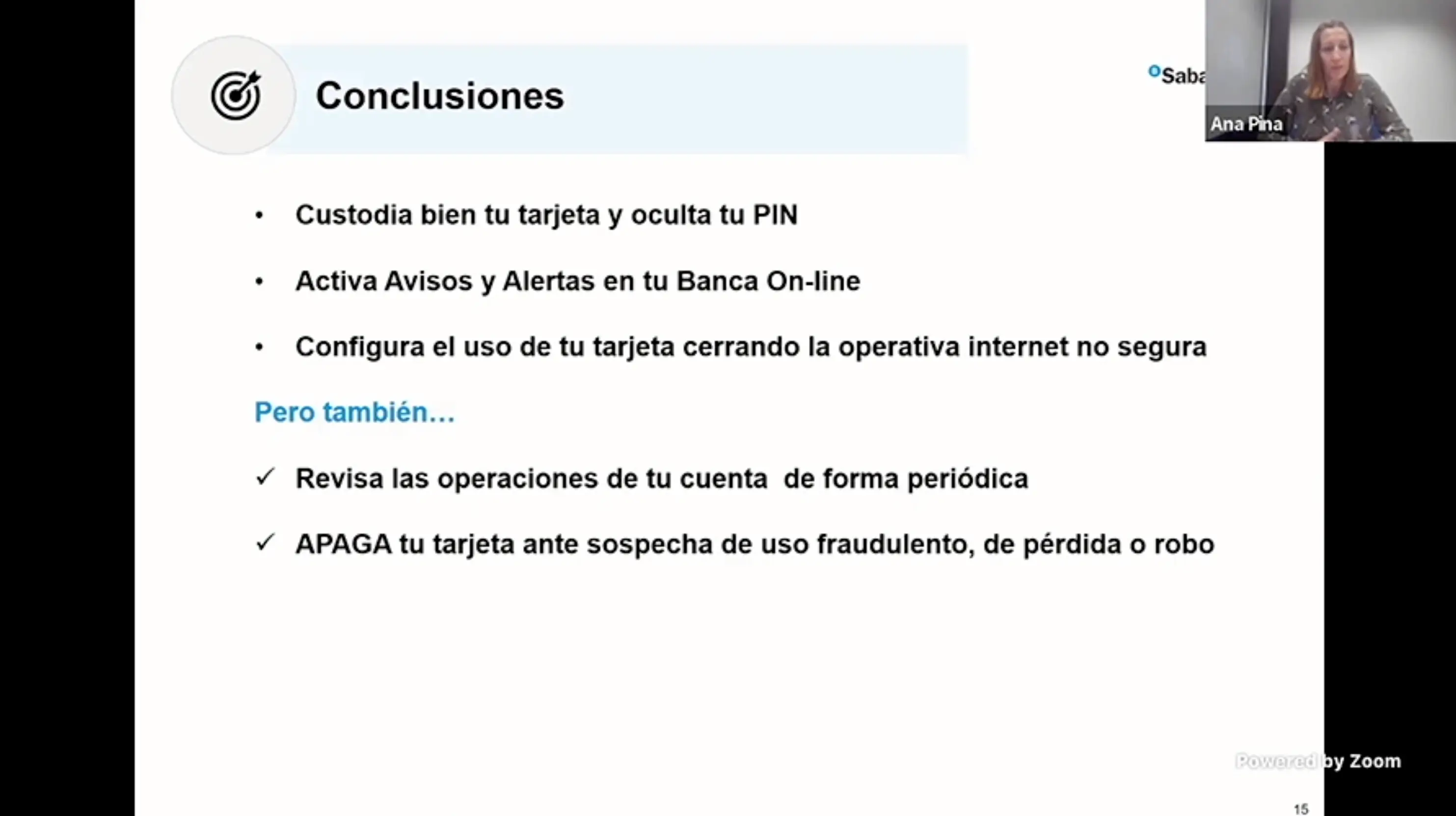

Despite numerous anti-fraud systems, the theft of your cards still poses a potential threat. The most common method is to watch while you enter your PIN and then stall and steal your card. To prevent these events, follow this advice:

- Do not let them see you enter your PIN and keep the card safe.

- Never have the PIN written down.

- Avoid easy number combinations and do not use personal data.

- Take extreme precaution with regard to safekeeping and PINs in cash machines and supermarket car parks.

- Have the notifications and alerts enabled within Online Banking.

- If you cannot find your card, deactivate it. If you do find it, you can always enable it again.

In case you cannot prevent the theft, it is important to keep the following advice in mind:

- Block the card as soon as we notice the theft.

- Immediately notify the bank: Specify whether your national Identity Card has also been stolen or not, as well as your mobile phone or smartwatch.

- Make the legal report.

In addition, card information can also be stolen when online shopping. In spite of all the existing security measures, at times, cybercriminals can get our data in one of the following ways:

- Breach in online shop’s security systems.

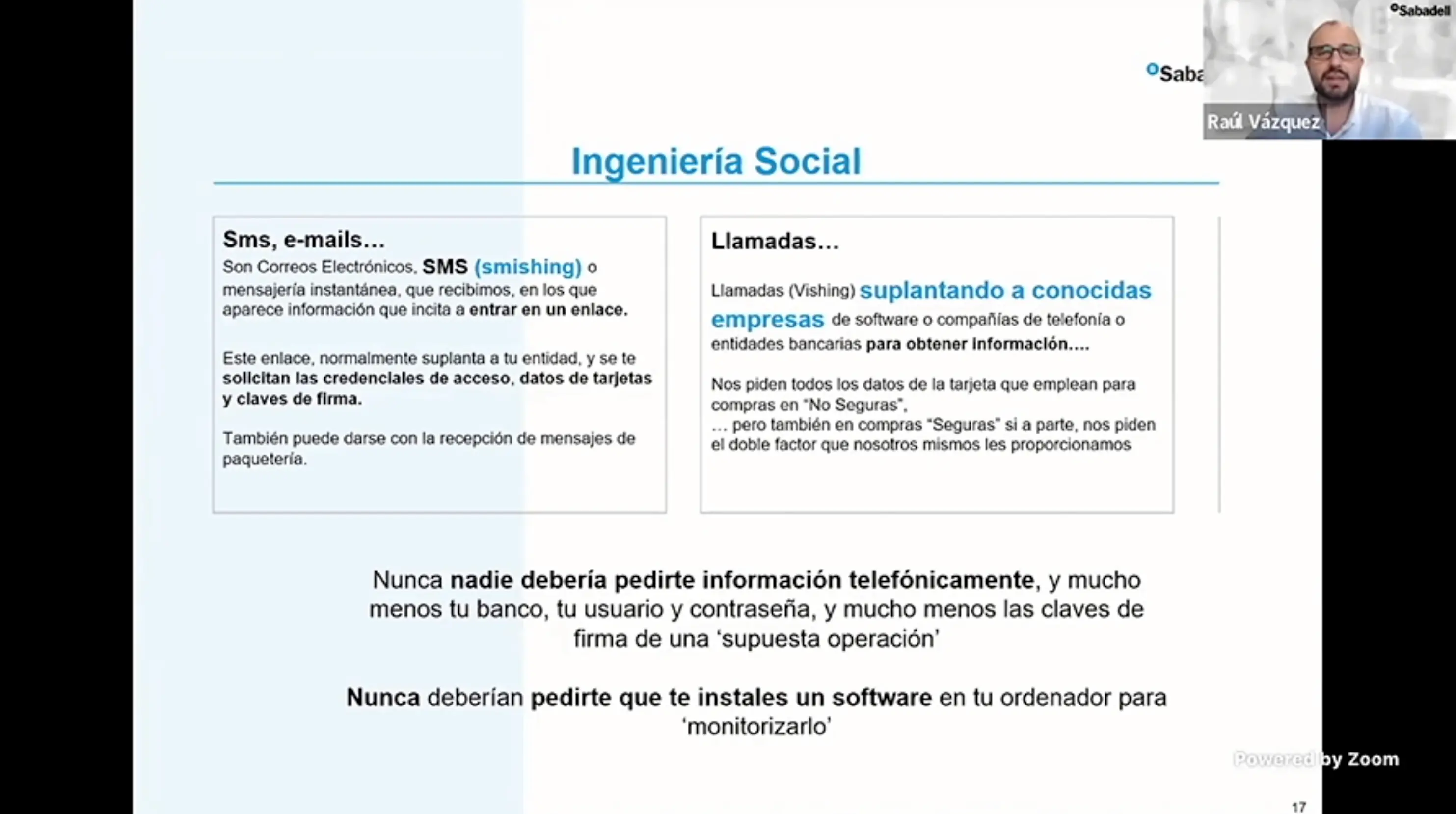

- Social engineering: Phone calls where a company is impersonated and, claiming some kind of service needs paying, you are asked to provide your card information. It also takes place through emails, fraudulent SMS messages (smishing) or instant messaging including information that encourages you to click on a link that impersonates your institution in order to illegally procure your access credentials, card details and signature codes.

- Locating cards on the web.

To prevent these threats, experts recommend following these tips:

- Have notifications and alerts enabled so as to quickly detect the first operation.

- Deactivate the ‘Do you want to make online transactions?’ option on your card through Online Banking once you have completed your online purchases.

- Use a single card for online payments.

- Review your account transactions regularly.

- If you suspect fraudulent use, loss or theft, deactivate your card.

At Banco Sabadell, we recommend you follow all these recommendations to make physical and online purchases as securely as possible. Remember that our customer service team is at your disposal to help you 24/7 on social media at @Sabadell_help and by phone at 96 308 500 for any card emergencies you may have.

If you missed out on the live webinar, you can watch it here.