- Net Profit declined 2.8% year-on-year. However, excluding extraordinary items recorded in 2024, net profit grew by 3.4%.

- The bank will return €4 billion to shareholders over the next 12 months: €700 million interim cash dividend distributed in the 2025 financial year, €800 million in share buybacks to begin on 9 February, and an extraordinary dividend to shareholders of 50 cents per share for the sale of TSB.

- CEO, César González-Bueno, said: "We end the year delivering on our commitments to the market. This enables us to confirm the forecasts set out in 2025-2027 Strategic Plan and announce an ambitious share buyback programme that increases ordinary shareholder remuneration for the year by around 9%".

- CFO, Sergio Palavecino, highlighted: "Banco Sabadell's business and balance sheet are driven by positive dynamics that have enabled the bank to generate capital very quickly over the course of the year. This has allowed the bank to self-finance its loan book growth and offer attractive shareholder remuneration".

- The bank raises its RoTE yield to 14.3% and places fully-loaded CET1 at 13.11%, after distributions to shareholders.

- The strong commercial momentum is reflected in higher volumes across all segments in Spain, with a year-on-year increase of 5.4% in the credit balance ex-TSB, and with customer funds rising by 6.4%.

February 6, 2026

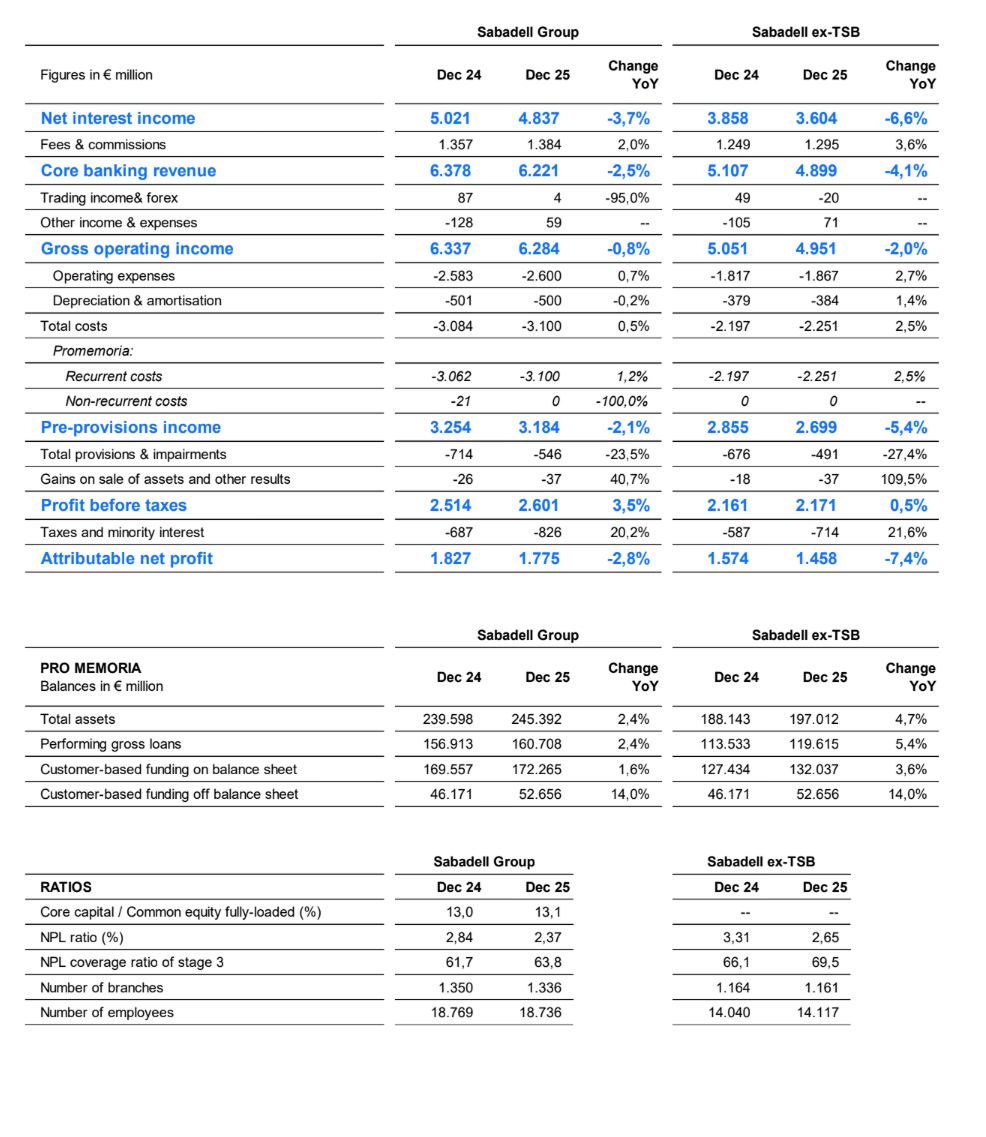

The Banco Sabadell Group achieved a net attributable profit of €1,775 million in 2025 (-2.8% year-on-year). Excluding the extraordinary items recorded in 2024, the bank's net profit grew by 3.4% year-on-year, supported by the improvement in asset quality and the reduction in provisions, as well as the strong boost in credit and funds volumes in Spain.

The Group's RoTE profitability rose to 14.3% and fully-loaded CET1 solvency rose to 13.65% (13.11% after considering the distribution of excess capital), representing an organic generation of 196 basis points during 2025.

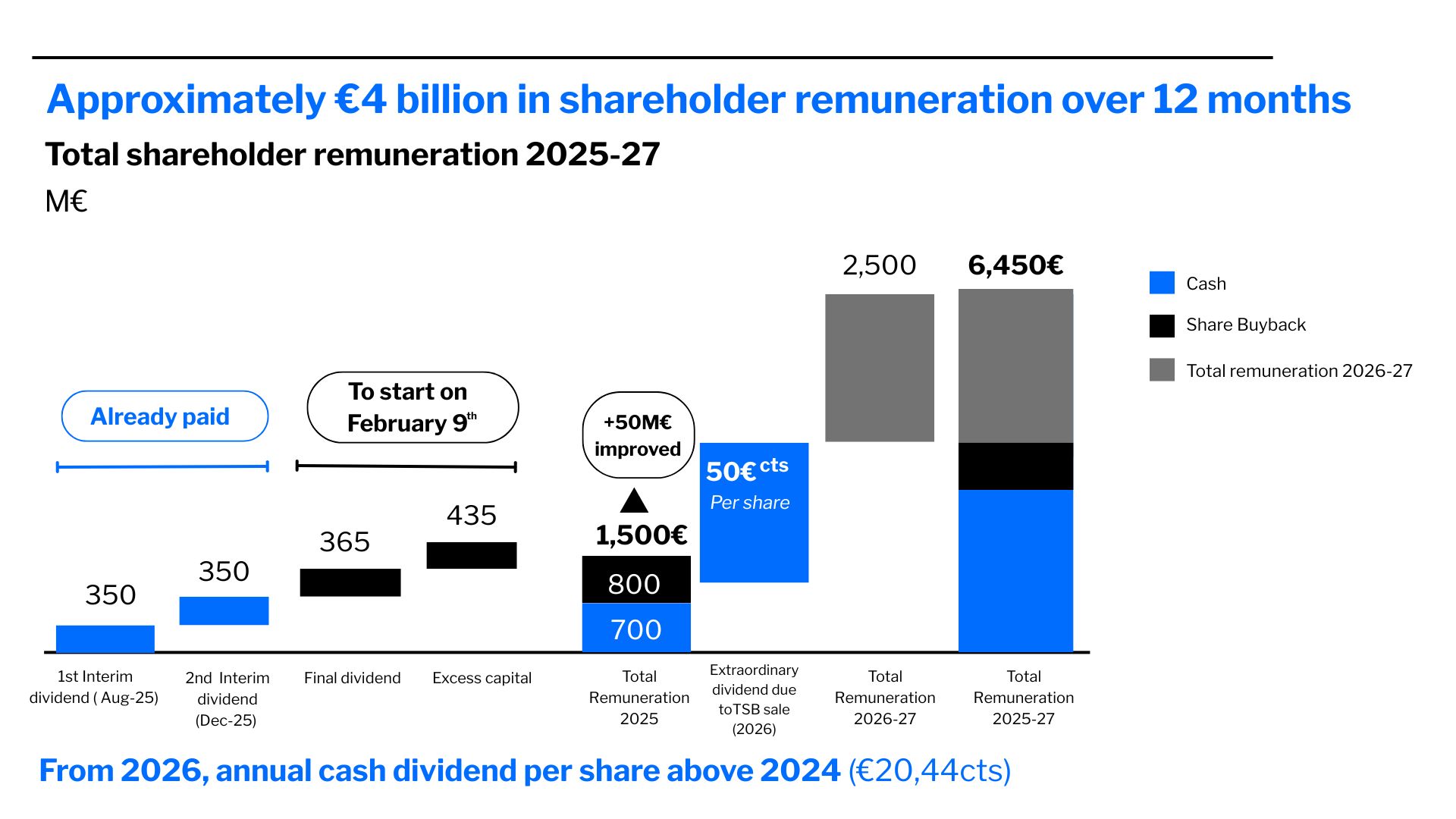

The bank has obtained authorisation from the European Central Bank (ECB) to launch a new share buyback for an amount of up to €800 million, which will begin next Monday, 9 February. This figure is made up of €365 million charged to 2025 results, plus €435 million from excess capital generated above 13%.

This remuneration of €800 million, together with the €700 million distributed in cash dividends on account of 2025 results, adds up to a total of €1,500 million in remuneration over the course of the year, equivalent to an annual return of approximately 9% of market capitalisation. In addition, Banco Sabadell will pay 50 cents per share for the sale of TSB, which means distributing around €4,000 million to shareholders over 12 months.

As such, the bank maintains its firm commitment to offer attractive and recurring remuneration for its shareholders, which it estimates at €6,450 million for the period 2025-2027 - representing about 40% of its current market value.

Banco Sabadell's Chief Executive Officer, César González-Bueno, stated: "We end the year delivering once again on our commitments to the market, which enables us to confirm the forecasts of our 2025-2027 Strategic Plan and announce an ambitious share buyback programme that increases ordinary shareholder remuneration in the year by around 9%, which will be further supplemented by the extraordinary dividend linked to the sale of TSB". The Institution's CEO added: "we have strong foundations, a clear and achievable plan and, most importantly, a team that is fully focused on the success of our strategy".

González-Bueno reiterated that "Banco Sabadell's plans are based on profitability targets that can sustain attractive shareholder remuneration which, as from 2024 and on a recurring basis, will be higher than €20.44 cents per share in cash".

For his part, Chief Financial Officer, Sergio Palavecino, noted that: "Banco Sabadell's business and balance sheet are driven by positive dynamics that have enabled it to generate capital very quickly over the course of the year, allowing it to self-finance loan book growth and offer attractive shareholder remuneration. All this, combined with greater profitability going forward, puts us on track to achieve our goal of reaching 16% RoTE by the end of our 2025-2027 Strategic Plan".

So, the bank meets its financial objectives and continues on the path of the 2025-2027 Strategic Plan. To achieve this, the bank has announced that it plans to increase commercial activity in Spain at a faster rate than the market in most business segments, increase the loan portfolio, improve its risk profile, increase revenues and maintain efficient cost management.

For 2026, the bank's forecasts point to a recurring RoTE of 14.5% (exTSB) and net interest income that will grow at a rate of more than 1%, while it estimates a mid-single-digit increase in the fee line and an increase in costs of 3%, while the total cost of risk stands at around 40 basis points.

Strong commercial momentum, with volumes up

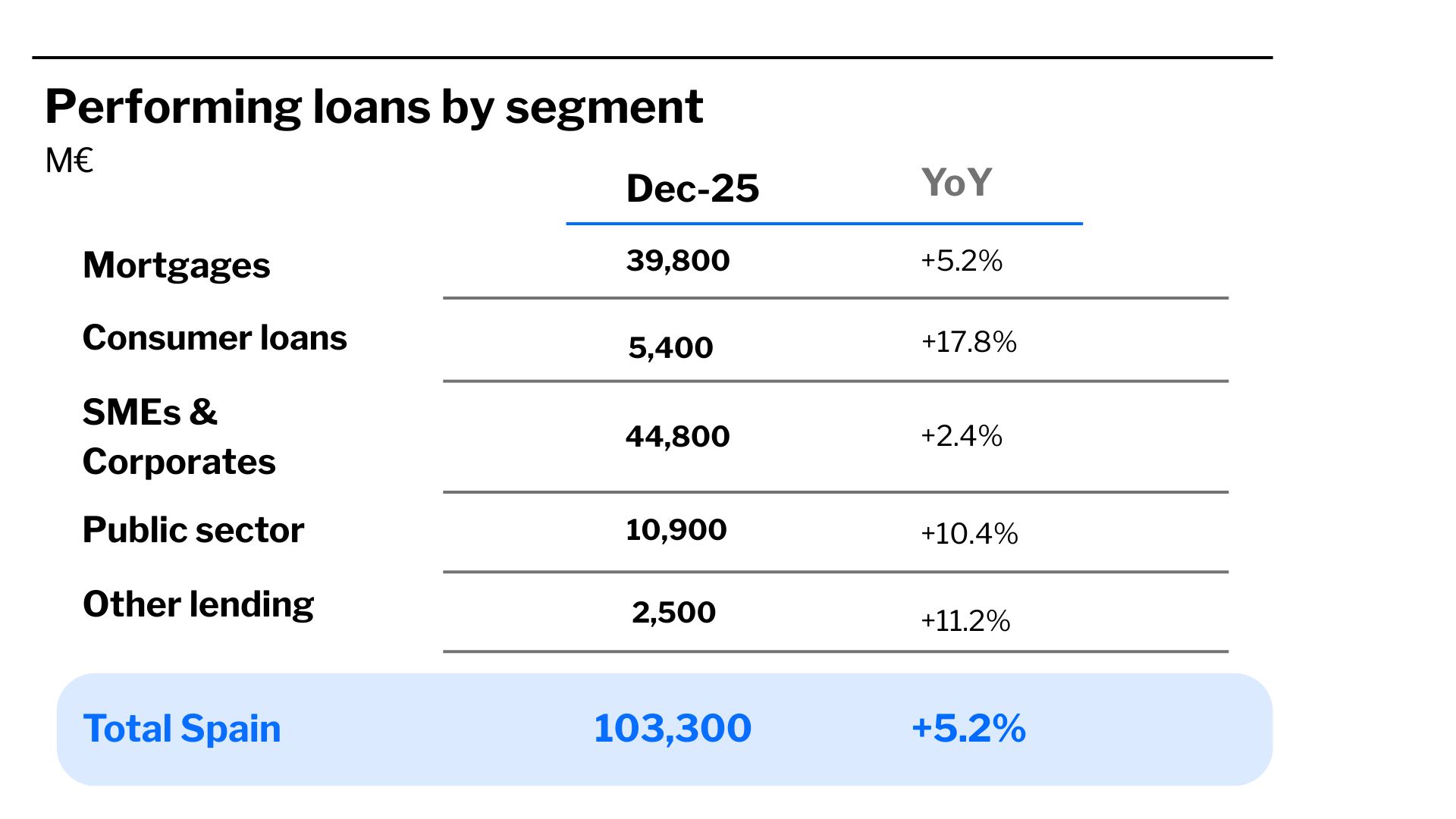

The commercial momentum experienced during the year puts the bank on the path to achieving its financial objectives. Banco Sabadell's outstanding loans performed positively in year-on-year terms, up 2.4% due to good performance in Spain, with growth in all segments to €160,708 million. Specifically, the outstanding loan book (exTSB) closed last December with a balance of €119,615 million, 5.4% more than a year earlier; a figure that amounts to €103,300 million (+5.2%) after excluding businesses abroad.

In Spain, outstanding mortgage loans rose by 5.2% year-on-year, to €39,800 million. Consumer loans amounted to €5,400 million, representing a year-on-year growth of 17.8% in the total outstanding portfolio. In the corporate loans and loans segment, the total portfolio grew by 2.4% year-on-year to €44,800 million. Card turnover was also positive, which increased by 6% in the year, to €26,611 million; while card terminals also increased by 2% for the year as a whole, with €57,947 million.

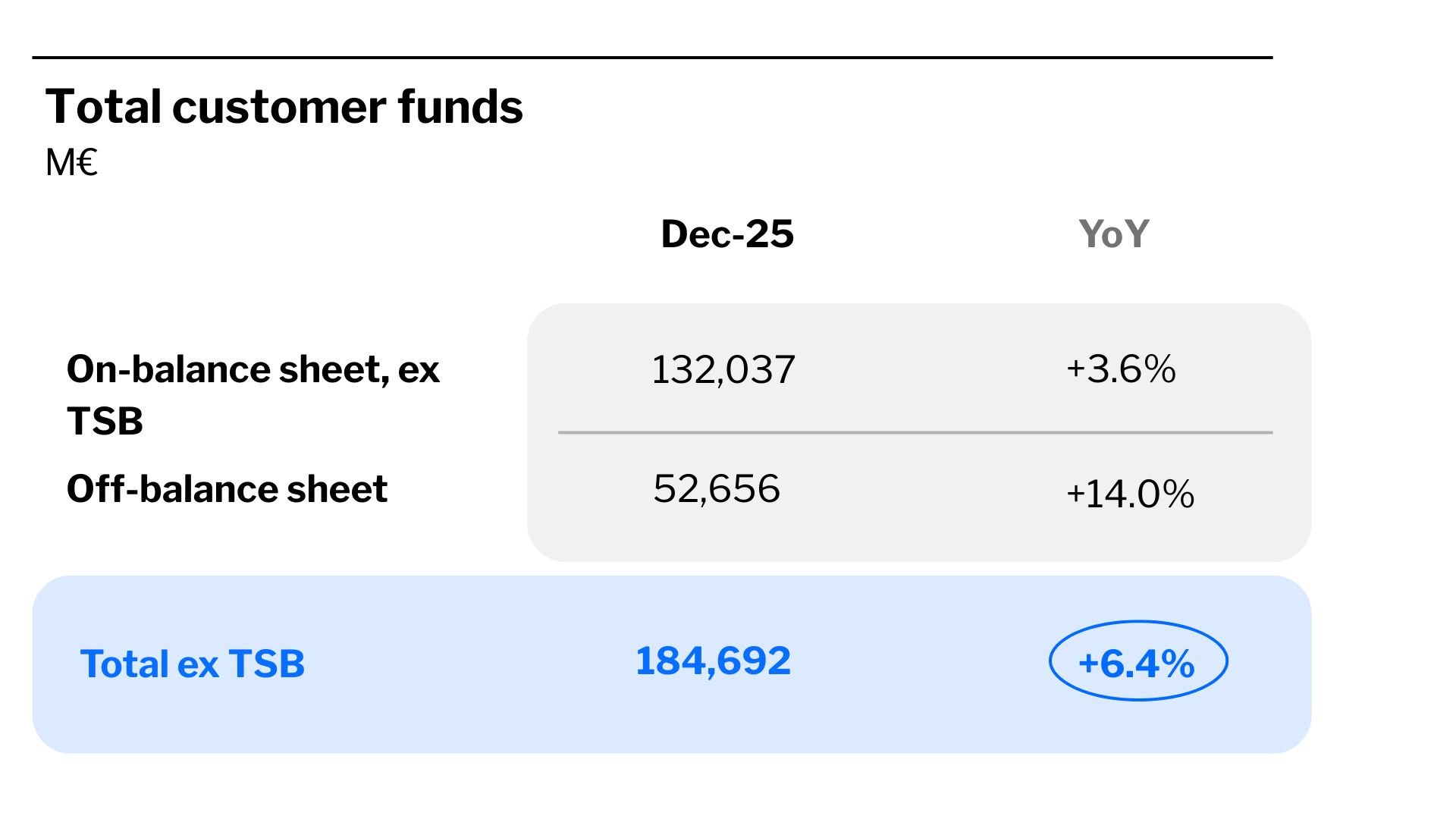

In terms of liabilities, total funds from exTSB customers amounted to €184,692 million at the end of December 2025, representing an increase of 6.4% year-on-year. In the Group as a whole, customer funds totalled €224,921 million, up 4.3%.

The Group's on-balance sheet customer funds totalled €172,265 million, up 1.6% year-on-year, with the main highlights being the positive performance of demand accounts. In this regard, demand account balances reached €143,400 million, up 3.7% year-on-year, while the balance of time deposits stood at €28,476 million, down 8.3% year-on-year, due to the transfer to off-balance sheet products.

Total off-balance sheet customer funds amounted to €52,656 million at the end of December, an increase of 14% year-on-year, due to the good performance of mutual funds, with positive net subscriptions, as well as the increase in marketed insurance and wealth management.

Lower provisions and improved cost of risk

In terms of earnings, Banco Sabadell reported income from the banking business (net interest income plus net fees and commissions) of €6,221 million in 2025 as a whole (-2.5%). Net interest income stood at €4,837 million, representing a year-on-year reduction of 3.7%, in line with expectations, mainly due to lower interest rates.

However, net fees and commissions rose to €1,384 million at the end of the 2025 financial year, up 2% in the Group and 3.6% excluding TSB, as a result of higher income from fees and commissions related to asset management and insurance.

Total costs stood at €3,100 million between January and December, with a slight increase of 0.5%. As a result, the Group's efficiency ratio - including depreciation and amortisation - stood at 49.3% at the end of the year.

In turn, the 23.5% year-on-year reduction in provisions has allowed the bank to achieve an improvement in the cost of credit risk, which has been set at 21 basis points in the Group at the end of December and at 24 basis points at the exTSB level. Likewise, the cost of total risk also improved

Non-performing loans fall and coverage rises

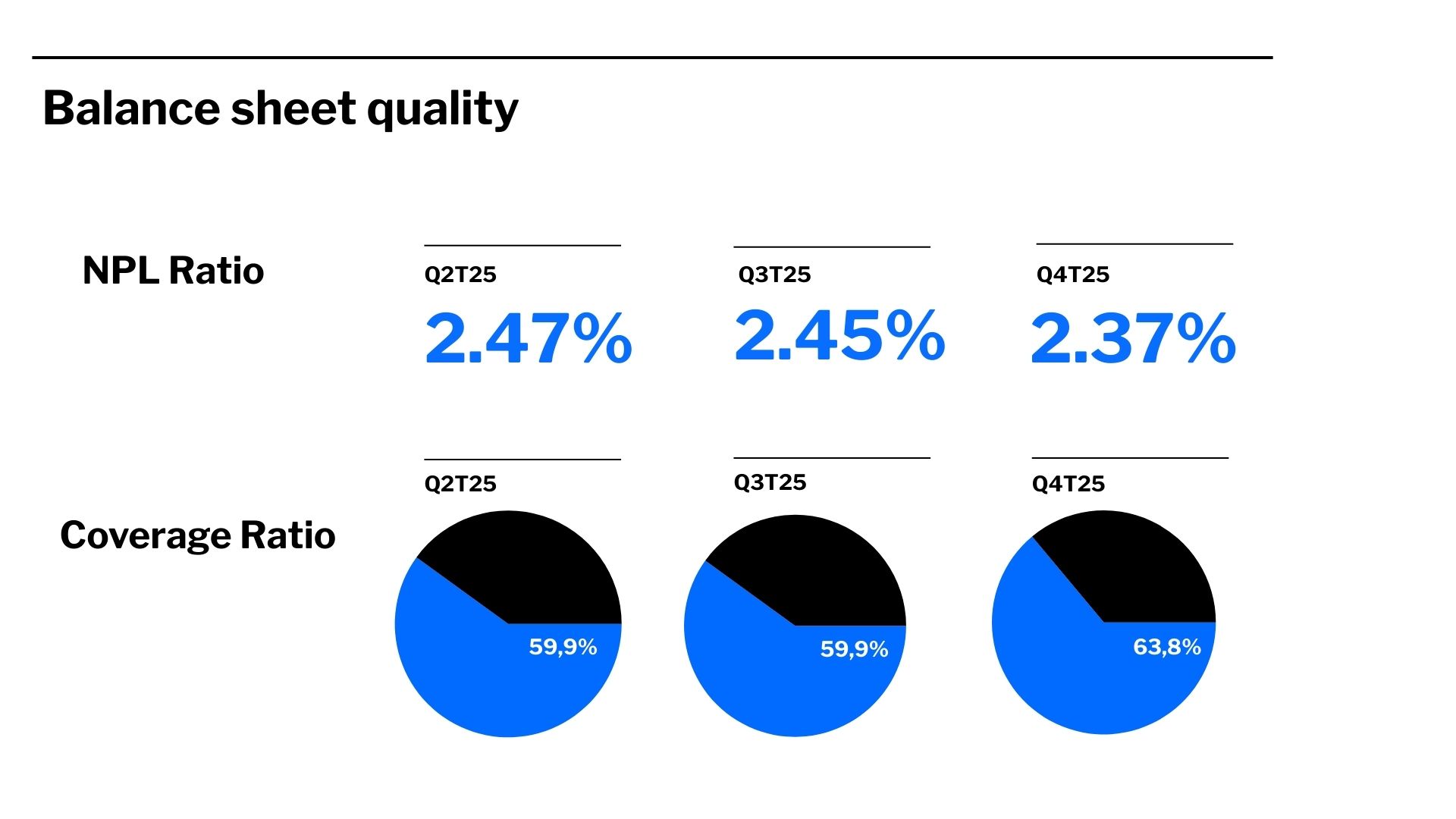

In terms of balance sheet quality, the Group's NPL ratio improved to 2.37%, while the stage 3 coverage ratio with total provisions increased to 63.8%. The same trend carried through at the exTSB level, where the NPL ratio fell to 2.65% and the stage 3 coverage ratio while total provisions rose to 69.5%.

The good performance of the NPL ratio was the result of the fall in non-performing assets by €193 million in the quarter, with a reduction in the balance of stage 3 of €148 million and that of non-performing real estate assets of €45 million. In the year-on-year comparison, the balance of problematic assets fell by €877 million, of which €725 million correspond to stage 3 balances and €151 million to problematic real estate assets.

The balance of non-performing assets (NPAs) stood at €4,803 million at the end of December, of which €4,119 million correspond to stage 3 assets, and €684 million to problematic real estate assets.

Organic Capital Generation

In addition, the bank continues to generate capital on a recurring and organic basis at very high rates. The fully-loaded CET1 ratio considering the distribution of excess capital stood at 13.11% at the end of 2025. Capital generation was 20 basis points in the quarter and 196 basis points in the year.

Total Capital ratio amounts to 18.23%, which is above requirements with an MDA buffer of 391 basis points.

TSB's net book value grows

TSB has reported an individual net profit of £259 million at the end of the 2025 financial year, which represents an increase of 24.7% year-on-year. The British subsidiary ended the year with a contribution of €318 million to the Banco Sabadell Group, which represents 25.6% more than the previous year.

Its net interest income stood at £1,056 million in 2025, up 7.2% year-on-year; while fees and commissions fell by 15.5% year-on-year to £77 million. In turn, total costs closed down 2.6% to £744 million.

Banco Sabadell agreed to sell TSB for an amount of £2,650 million as of March 31, 2025. However, the tangible net book value (TNAV) generated between that date and the closing of the transaction must be added to this price. Since then, TNAV has increased by £154 million.