12 de septiembre de 2025

Últimas novedades sobre la OPA

Recomendación del Consejo de Administración sobre la OPA hostil de BBVA

La OPA hoy

La oferta lanzada por BBVA consiste en canjear acciones de Banco Sabadell por acciones de BBVA de nueva emisión, además de un pequeño componente en efectivo.

Esta operación se lanza después de que BBVA presentara al Consejo de Banco Sabadell en abril de 2024 una propuesta unilateral de fusión, que el Consejo rechazó al considerar que no era atractiva para accionistas, clientes, empleados y demás grupos de interés.

1 acción

de Banco Sabadell

0,18 acciones

de BBVA + 0,126€ en efectivo

Con el canje inicial del 09 de mayo de 2024, a los accionistas de Banco Sabadell les correspondía el 16,17% del nuevo BBVA, pero tras el último ajuste del canje por pago de dividendos del 27 de agosto de 2025 y los diferentes programas de recompra de acciones anunciados, se estima que solo les correspondería un 13,58%.

Ejemplo de lo que obtendría hoy un accionista de Banco Sabadell en caso de aceptar la oferta de BBVA:

10.000€ en acciones

de Banco Sabadell

9.484,43€ entre acciones

de BBVA y efectivo

Con la propuesta de canje este accionista perdería 515,57€ del valor actual de su inversión

- Prima referenciada a cierre de mercado con fecha 17/09/2025.

- Si el precio de la oferta (valor acción BBVA+0,70€) es inferior al precio de referencia (valor acción BS x 5,5483) la prima es negativa. En caso contrario sería positiva.

¿Qué debe saber para poder decidir si acude a la OPA

o se mantiene como accionista de Banco Sabadell?

HASTA AHORA

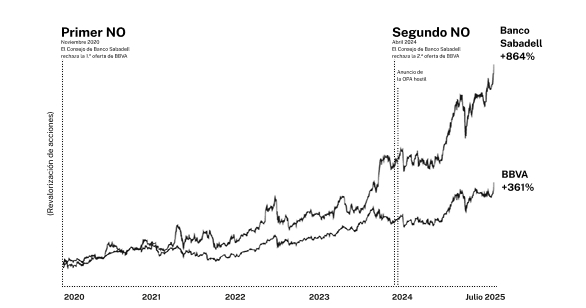

Noviembre de 2020: Primera negativa a fusionarse con BBVA1

Un accionista que el 13 de noviembre de 2020 tenía 10.000€ en acciones de Banco Sabadell ahora tiene una inversión con valor de 106.316€ (valor de la acción + dividendos cobrados).

Sin embargo, si hubiera sido accionista de BBVA su inversión de 10.000€ se habría convertido en 52.580€ (valor de la acción + dividendos cobrados).

Abril de 2024: Segunda negativa a fusionarse con BBVA2

Un accionista que el 29 de abril de 2024 tenía 10.000€ en acciones de Banco Sabadell ahora tiene una inversión con valor de 19.830€ (valor de la acción + dividendos cobrados).

Sin embargo, si hubiera sido accionista de BBVA su inversión de 10.000€ se habría convertido en 14.073€ (valor de la acción + dividendos cobrados).

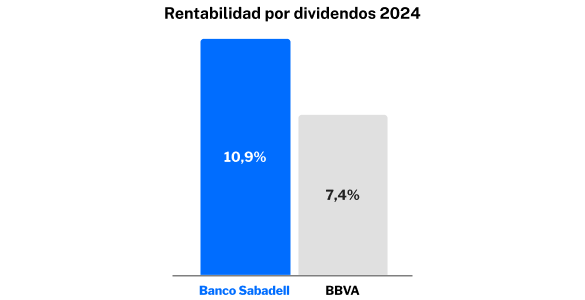

Rentabilidad por dividendos 2024:

- Banco Sabadell: 10,9% la mayor de todas las empresas del IBEX 35

- BBVA: 7,4%

Sabadell es el valor que más ha subido en la bolsa española (IBEX 35) desde el cierre de 2020.1

Además Sabadell es el banco que más ha subido en Europa (STOXX EUROPE 600) desde el cierre de 2020.1

Hemos batido las expectativas de resultados año tras año.

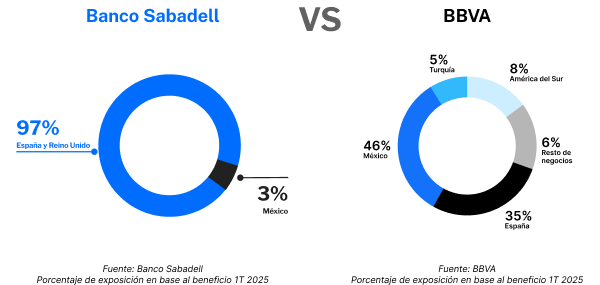

El 97% de nuestro beneficio proviene de mercados estables y predecibles (España y Reino Unido), lo que permite mayor previsibilidad sobre nuestros beneficios futuros.

Más del 60% del beneficio de BBVA procede de economías emergentes: Mexico, Turquía y América del Sur.

Decir no a BBVA ya le salió bien dos veces a Banco Sabadell: El Consejo de Administración de Banco Sabadell ha rechazado dos veces en los últimos años las ofertas de fusión de BBVA. Tras decir NO a BBVA en dos ocasiones Banco Sabadell ha alcanzado la mejor situación financiera de su historia.

- Desde que en noviembre de 2020 el Consejo rechazó seguir negociando su fusión con BBVA la acción de Banco Sabadell se ha revalorizado x9,811, mientras que la de BBVA ha subido x4,3.

- Desde que el 29 de abril se conoció el interés de BBVA por volver a negociar una fusión, a lo que nuestro Consejo se opuso, la acción de Banco Sabadell se ha revalorizado +70%, en línea con los bancos domésticos españoles, mientras, BBVA solo ha subido +30%.

1. Fuente Bloomberg. Datos a 23 de mayo de 2025. Resultados en base 100 y ajustado por ampliaciones de capital y dividendos.

El Consejo de Ministros ha autorizado a BBVA a seguir adelante con la OPA hostil, pero ha establecido condiciones adicionales a las aprobadas por la CNMC.

Según su decisión, de salir adelante la operación, BBVA y Banco Sabadell tendrían que actuar con total autonomía de gestión durante los próximos tres años (ampliables dos años más), además de mantener separadas las personalidades jurídicas y patrimoniales de cada entidad. Por lo tanto, al menos durante ese plazo, no podría ejecutarse una fusión entre ambas entidades, imposibilitando la materialización completa de las sinergias de costes perseguidas.

1. Como mínimo hasta una fecha posterior al vencimiento de la condición impuesta por el Acuerdo del Consejo de ministros (como mínimo durante tres años, con la posibilidad de extensión hasta cinco años) y si la fusión fuese autorizada.

BBVA tendrá que detallar el folleto de la OPA sus previsiones de sinergias y de coste de capital que le acarrearía la operación.

- Ninguna de las anunciadas sinergias de costes se podrá alcanzar al menos durante la vigencia de la condición impuesta por el Acuerdo del Consejo de ministros (como mínimo durante tres años, con la posibilidad de extensión hasta cinco años).

- Esto es así porque la condición exige que “cada entidad mantenga la autonomía en la gestión de su actividad” y “la maximización del valor de cada una de las entidades por separado, no del conjunto formado por las dos”.

Rentabilidades pasadas no constituyen un indicador fiable de las rentabilidades futuras. Las previsiones no garantizan resultados futuros. Le recordamos que la inversión en acciones conlleva el riesgo de pérdidas en el capital invertido.

La evolución del precio y la rentabilidad de las acciones están sujetas a riesgos de fluctuación por factores intrínsecos al propio emisor, entorno y sector de actividad, o riesgos derivados de las distintas variables que afectan, con carácter general, al mercado en que se negocian, lo que puede comportar un escenario tanto de ganancias como de pérdidas, incluso sin reparto de dividendos.

Revalorización anual acción Sabadell anterior a 16/06/2025; 2020: -66%; 2021: 67%; 2022: 49%; 2023: 26%; 2024: 69%; 2025 hasta junio: 51%. Revalorización anual acción BBVA anterior a 16/06/2025; 2020: -19%; 2021: 30%; 2022: 7%; 2023: 46%; 2024: 15%; 2025 hasta junio; 40%. Fuente: Bloomberg LTD.

Ver más sobre la OPA ‘hostil’

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-1.webp)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/img-folleto.png)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-1-1.png)

![$cards_featured_list_img['title']](https://comunicacion.grupbancsabadell.com//wp-content/uploads/Card-2.webp)